Scott Sumner asks an important question – why is the yield curve flattening? Scott thinks it’s because of a faster decline in the unemployment rate at a time when the pace of NGDP growth is slowing:

“The rapid fall in unemployment explains why a rate increase is expected within less than a year, and the declining estimates of trend NGDP growth explain why rates are not expected to rise as far after that first rate increase.”

I don’t know. As someone who trades a good bit of fixed income I think that view overcomplicates how the markets actually set the price of yields. Most fixed income traders view long rates as a function of the economy and short rates as a function of the Fed’s views on the economy. So, when the Fed increases rates it means that the Fed thinks the economy is improving and needs some tightening so it doesn’t cause the Fed to create too much inflation and overheat the economy. But fixed income traders account for this and front-run the Fed’s thinking by trying to anticipate their views on the economy. Said more simply – long rates are a function of short rates for the most part. And the fact that long rates are remaining low means that fixed income traders increasingly believe that we’re in a permanent state of low interest rates.

There’s some data that would seem to confirm this view. First, the standard deviation of yields has fallen over the course of a 6, 12, 18 and 24 month period. This means that traders are becoming increasingly confident in the stability of the low interest rate environment. If there was a strong likelihood of much higher rates in the future then this wouldn’t be happening. Rates would be much more volatile as the future interest rate environment would be far less certain.

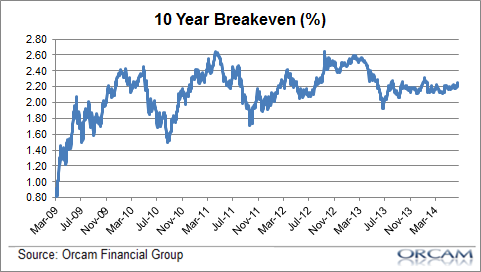

In addition, future inflation expectations have essentially flat-lined. This means that bond market really doesn’t see high risk of inflation in the future. So, if inflation is the driving force of future rate hikes (which is a logical assumption given that the unemployment rate is still historically high) then the bond market is showing very little signs of worry about future inflation. Of course, none of this means that bond traders are right and they could be misinterpreting the future, but I don’t think the story needs to be overcomplicated.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.