If you cite inflation statistics these days you inevitably run into the same counterpoints from those who have long been predicting hyperinflation in the USA. And despite the fact that there are still no signs of hyperinflation (or even high inflation) in the US economy the hyperinflationists remain convinced that they will one day be right. One of the classic responses that you hear from this crowd (aside from the misleading “gold is higher” argument) is not that they’ve been wrong, but that the data the government uses is “misleading” or “manipulated”. This always leads back to one place – Shadow Stats, which is a website known for recreating certain government statistics such as CPI and M3 in a manner that they claim is more accurate than the “manipulated” government data. The BLS and Shadow Stats had a bit of a back and forth a few years ago over this and several other economists have cited irregularities in the Shadow Stats data. Many others have defended Shadow Stats and their service is more popular than ever.

Now, I don’t necessarily believe that the approach that Shadow Stats uses is flawed. In fact, I think it’s incredibly valuable to have companies and independent analysts reviewing government data. After all, our democracy is dependent upon holding our government accountable. In this regard, the Shadow Stats site contributes a very valuable service.

So while I am not here to claim that the Shadow Stats data is not useful, I do think it’s important to highlight some interesting facts surrounding their application of this data and analysis in recent years. The most glaring is the accuracy of their most famous prediction. Shadow Stats has been predicting hyperinflation for at least 6 years now and every year the forecast gets bumped to the next year. For instance, in 2005 Shadow Stats said government spending was spiraling out of control and would inevitably lead to hyperinflation:

No Way Out — System Doomed to Hyperinflation The regular, annual $3.5 trillion shortfall in government operations cannot be covered by Uncle Sam; the situation has deteriorated beyond any hope of a solution within the existing system. Raise taxes? Even a 100% personal income tax would leave a deficit. Cut spending? Spending cuts that would bring government fiscal conditions into some semblance of order would be so draconian as to be beyond any political possibility in today’s environment. What remains inevitable — only a matter of time — is a national bankruptcy.Such circumstances in the past — though no nation on earth has ever come close to experiencing the level of fiscal and financial fraud now being perpetrated on the American people — typically have been “cured” by revving up the printing presses and creating excessive quantities of money. The end result is a monetary collapse in a hyperinflation, with the currency becoming worthless. For a detailed discussion of a possible U.S. hyperinflation as well as a history on the GAAP accounting reports, see “Federal Deficit Reality: An Update” (July 7, 2005). “

The head Economist of Shadow Stats, John Williams, became increasingly vocal about hyperinflation as the years passed. In 2007 he rightly predicted a recession. But the recession he foresaw was a hyperinflationary recession. In 2008 Shadow Stats issued a special hyperinflation report. It said:

“Official CPI could be running in double-digits by year-end 2008….The efforts by the federal government and the Federal Reserve to prevent a systemic collapse as a result of the banking solvency crisis has started to spike broad money growth, as measured by the SGS-Ongoing M3 measure, which currently shows a record annual growth rate of 17.3%. While the Fed has not been formally creating new money — yet — by adding to reserves, it has had the effect of creating new money by re-liquefying otherwise illiquid banks, by lending liquid assets versus illiquid assets. As a result, a number of banks have been able to resume more normal functioning, lending money and creating new money supply. As the systemic bailout proceeds, formal money creation will follow and already may be starting to show up in official accounting.”

Now, from the Monetary Realism perspective there is a whole lot wrong with this picture. The comments on reserves imply that the Fed adds new money via programs such as QE2. Regular readers know this is simply not true and it is why their predictions surrounding the QE’s with impending hyperinflation have been wrong thus far. What we tend to see from hyperinflationists when discussing QE is that the Fed is monetizing the debt and adding substantially to the money supply by adding reserves. In 2010 John Williams said:

“The weakening in broad money growth is despite the initial Treasury-debt monetization in the second

round of “quantitative easing.”

He then showed a very scary chart of the monetary base – the one which depicts a vertical line which would give one the impression that the broader money supply is exploding. The only problem here is that QE is not debt monetization and it is not money printing. We know this because we now have rock solid evidence that adding reserves to the banking system is in no way inflationary – in fact, the money multiplier has now even been rejected by the Fed itself. Because banks are never reserve constrained there is never a need to be alarmed by the Fed’s swapping of reserves for bonds (at least not for the reasons hyperinflationists would have you believe).

Shadow Stats also recreates M3. According to their own data, M3 collapsed in 2009. It has since recovered but remains at relatively meager levels when compared to the period where the hyperinflation predictions started in 2005 when M3 was surging at near double digit levels.

So, when we look back at those 2005 hyperinflation predictions one can’t help but be reminded of all the traders in Japan who have been shorting Japanese Government Bonds since 1990. Or the various economists who have been predicting the inevitable rise of the bond vigilantes in the USA. Some have been making this prediction for decades now. But like the hyperinflationists, they have misinterpreted the actual operational realities of our monetary system and in doing so have made predictions that are unlikely to come true.

On a slightly different note, I always find it interesting how those pushing the hyperinflation theme love to collect U.S. Dollars. For instance, if you visit Shadow Stats you can buy a subscription to their services for a fee – in U.S. Dollars. Now, a hyperinflationist would argue that they are using those dollars to buy hard commodities so that’s a valid point, but the problem is that there are no signs of hyperinflation in the Shadow Stats subscription service. In fact, in real terms, the subscriptions are deflating! If one goes back and reviews the cost of the service it has remained remarkably stable in price:

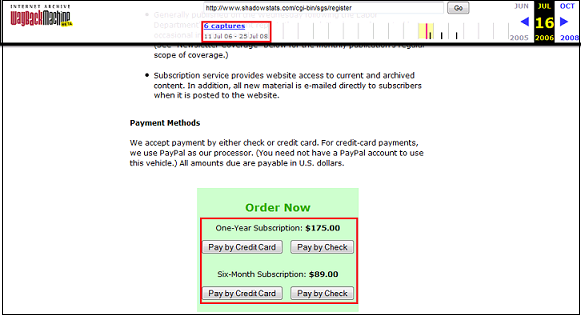

(Figure 1 from July 16th, 2006)

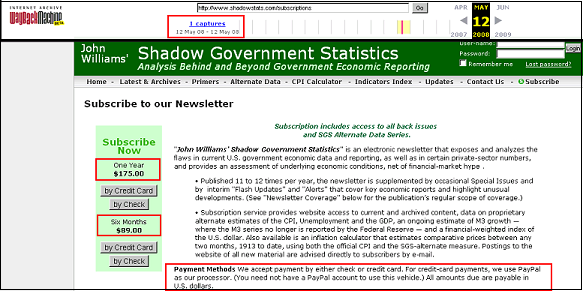

(Figure 2 from May 12th, 2008)

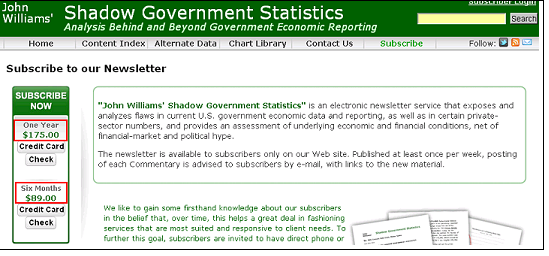

(Figure 3, from August 28, 2011)

According to the US government inflation should have caused those subscriptions to surge to $197 in 2011. But your Shadow Stats subscription has actually gone down in price since 2006 because inflation has risen a total of 13%+ according to the CPI. Of course I am cherry picking here and I am not showing the data in terms of gold or what could be viewed as a general decline in our standard of living. In fact, I think one could make a good case for the idea that our standard of living has declined since 2006 (not the case since 1913 when the Fed was founded or since 1971 when we went off the gold standard, but that’s a different matter). But you can see the irony regardless.

The bottom line is, no matter how one views all of this data, it’s practically impossible to conclude that the hyperinflation predictions have been remotely true. Perhaps the hyperinflationists will be right in the coming years. But as regular readers know, I doubt that will be the case as hyperinflation has tended to be the result of exogenous factors and not merely the monetary event that many like to make it out to be. The good news here is that hyperinflation forecasts are as affordable as ever so get in while the getting is good (or while the getting is bad?).

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.