I’d like to thank the Federal Reserve for ruining my day. I had expected the 2013 Survey of Consumer Finances to tell a happier story when it was released this year, but the new report is downright depressing. Although the stock market has boomed and the economy appears to be making a comeback from the 2009 crisis, the Fed’s survey tells a much bleaker story.

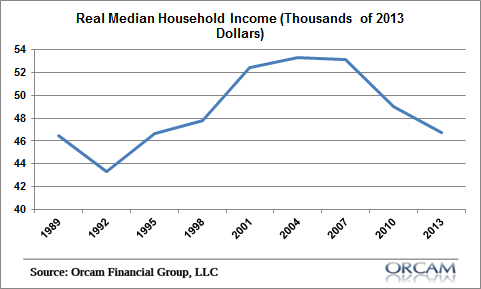

This depressing story can be summed up in three simple charts. The first shows real median household income since 1989 – essentially flat:

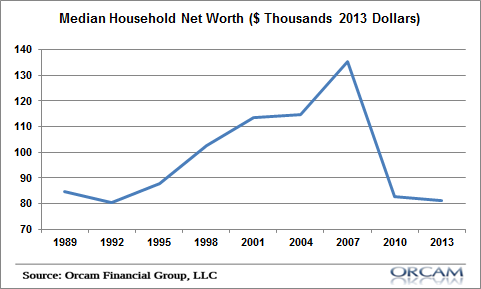

But what about the financial markets? They’ve boomed since then, right? Yes, but household net worth has cratered from the highs and is essentially flat in real terms since 1989:

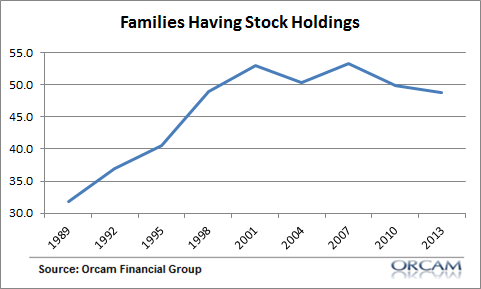

A big part of the reason why is the result of increased levels of debt and the collapse in housing prices. But another factor is the stagnant ownership of stocks. While the stock market has boomed in the last few decades and reaches a new all-time high the number of families who own stocks has been stagnant since the late 1990’s:

This is still a remarkably uneven recovery.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Frederick

Depressing indeed. I can’t believe the net worth number is so depressingly low.

jaymaster

I’ve read elsewhere that the median income number is hugely

impacted by the number of baby boomers retiring, and to a lesser extent, by younger

population spending more time in school.

If that’s the case, then we probably won’t see an increase in that

number until the next big population wave hits their peak earning years

(probably 10-15 years away).

https://www.advisorperspectives.com/dshort/guest/NDD-140528-Real-Median-Household-Income.php

The number of people owning stocks could very well be

impacted by both of those trends as well. Retirees might be annuitizing or switching

to bonds. And younger folks just aren’t investing yet. Plus many people are

afraid of stocks now.

Of course, the drop in net worth is not nice. But I’d suspect that’s dominated by housing prices, and less so by increasing debts.

The peak numbers around the mid 2000’s were probably not “real”, but

rather an artifact of the bubble.

willid3

hasnt income growth pretty much been stagnant for longer than just from 2007? doesnt look like it grew much except for the growth in the middle 1990s. past that not so much

Frederick

This also explains why the impact of QE hasn’t been very significant. It’s only helping the wealthy.

LoLattheUS

According to this report: 90% being economically exterminated, the top 10% are flat, the top 3% (not 1%) is the only demographic that made gains.

“This is still a remarkably uneven recovery.” –

If the report is accurate, that is an understatement of the Century, and quite the nice little dystopian society being created if true.

tealeaves

For perspective, the US recovery is similar but not as dour as Japan’s most recent QE experiment where

1. Japanese assets (equities) rallied post QE and

2. Modest GDP growth until this past quarter which was negative and

3. Wages did not rise due to slack in the economy and

4. Capex continues to stall but

5. Japan has a higher and positive CPI (driven by lower Yen) for now

For the Japanese working class is terrible as wages stall but prices increase as a result of their weak currency policy.

For the US the situation is similar with the exception that GDP prints have been stronger and the USD has been stable through their QE announcement which caps commodity prices and limits domestic commodity price inflation. I think the US consumer and corporations have it a small bit better then most other economies as the strong dollar (low oil prices) gives them more discretionary income. But they still haven’t received a share of the corporate profits in the form of real wage improvements.

james

depressing also that ‘wealth extraction’ through corporate buy back and dividend boosting net wealth of a few vs. capex for the benefit of society at large. No capex (private), no investment in infrastructure (gov), i spend 4 months every year in the US and it is 360 degree short termism and no future

birrre

More than 50% of the U.S. population are now singles, check this link:

https://www.bloomberg.com/news/2014-09-09/single-americans-now-comprise-more-than-half-the-u-s-population.html

John Daschbach

These are important data, but they are always semi-arbitary cuts through a high dimensional non-linear domain. At the macro level there is conceptually a mapping from real productivity to real gains. But in reality this is convoluted with huge external distortions. We don’t know what the “equilibrium” conditions are, so it’s impossible to rationally argue that increased levels of debt are good or bad, or any other observable. People confuse the financial world for the real world, a world in which real productivity is balanced by real consumption plus the storage of current real productivity (which has a decay time constant) and minus the consumption of past real productivity. The financial world is a system which imperfectly attempts to apply the real world to the financial world.

jaymaster

Wow, I was not aware of that. That would have to impact the numbers too.