The Tax Policy Center has crunched the numbers on Mitt Romney’s tax plan and the findings are pretty interesting. They used the CBO’s baseline estimates and then included the various tax cuts that Governor Romney is calling for. Of course, this is only the revenue side so we don’t know what kind of spending cuts Romney might have in store for us, but just looking at the revenue side one might be inclined to argue that Romney will be a bigger spender than Obama is! Here’s the Tax Policy Center on the plan:

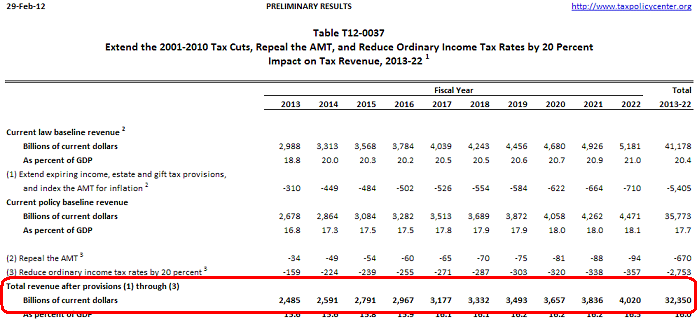

“Last week, Mitt Romney proposed a new tax plan that would, among other things, reduce individual tax rates by 20 percent across the board and repeal the Alternative Minimum Tax. To get a rough sense of what those two tax cuts would cost, the Tax Policy Center crunched the numbers. The result: They would be really, really expensive.

TPC found that repealing the AMT and cutting rates by 20 percent would increase the deficit by more than $3 trillion over the next 10 years, even after the 2001/2003/2010 tax cuts are extended.”

(Source: Tax Policy Center)

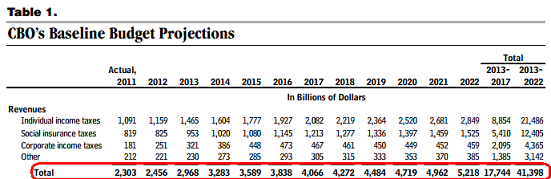

(Source: CBO)

Of course, as Treasury Secretary Geithner explained just recently, a tax cut is the equivalent of a spending increase in terms of its effect on the federal budget. The main difference is that the government doesn’t decide specifically how to allocate the funds. Now, it’s impossible to know what the Romney budget will actually look like until we see it, but his plan for revenues is certainly the equivalent of a big spending increase from the CBO’s current baseline. For instance, Obama’s next term is projected at $13.6T in revenues while the Romney plan is calling for just $10.85T in revenues. Based on that, one might argue that Romney will end up running sizable budget deficits that any Keynesian would fall in love with. But clearly, it’s too early to make such broad conclusions since we only have one side of the ledger to work with….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.