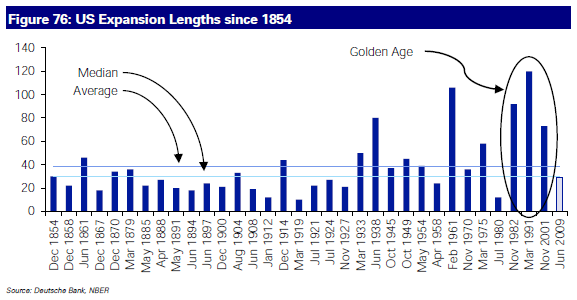

History may not be on the side of those calling for recession currently. According to recent data from Deutsche Bank the current expansion is still on the shorter end of the historical average length.

Since 1854 the average expansion has lasted 40 months. Since the great depression the average expansion has lasted 58 months. The last 7 expansion, however, have lasted almost 70 months on average. At month 27 the current expansion would be short by historical standards. Of course, if you’re following my balance sheet recession theory this is a relatively moot point, but if we’re going to following the standard NBER data points on recessions then this casts doubt on the odds of a technical recession occurring in the coming 12 months.

DB, on the other hand, says we could be in for recession in 2012 as we near that average point. They claim recent history has been an anomaly and not the norm:

“The “Shorter Business Cycle” theory has become the cornerstone to our macro thoughts over the last 18 months. The conclusion was that using evidence from history there was a very good chance that the next recession would start by 2012 especially once we concluded that the artificially long business cycles of the “Golden Era” were a thing of the past. Figure 76 shows the length in months of each completed expansion seen since 1854 with the current cycle added at the end for context.

We think that the three ‘super-cycles’ between 1982-2007 were the exception rather than the norm and existed largely because of a near 30 year secular global decline in inflation that transcended the business cycle. This was perhaps caused by Globalisation and the reduction in cost pressures that it facilitated. We think that the Western authorities ‘maxed out’ on the benefits of this inflationary decline by pumping monetary and fiscal stimulus into their economies whenever they had an economic problem. Given the lack of inflationary pressures they had a rare ability to do this without the normal subsequent price rises.”

Source: Deutsche Bank

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.