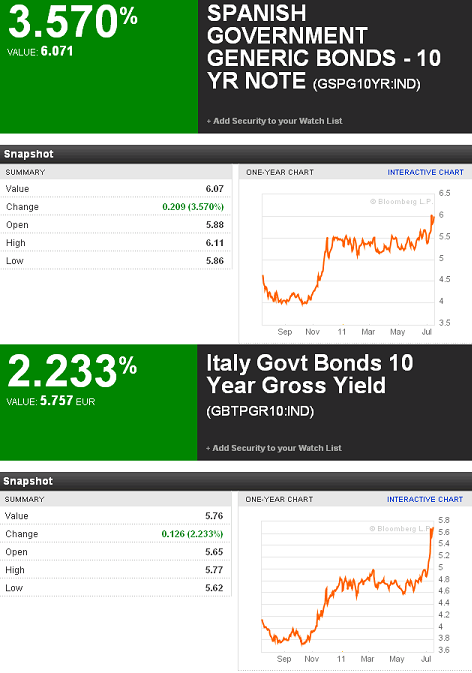

When I said the chart of the Spanish 10 year yield was the most important chart in the world I was wrong. It turns out that the problems in Europe could be even worse than I thought. The markets are not even stopping at Spain. They appear to be going for Spain AND Italy. Remember, unlike the USA, there really are bond vigilantes in Europe. These nations have very real solvency issues and investors are increasingly concerned.

What’s alarming is that we’ve seen this movie before. Once the bond vigilantes get a bit of confidence they have tended to become increasingly bold. That’s the lesson from Greece, Ireland and Portugal where yields crept around the 5%-6% range before spiking and trending into the double digit range. Thus far, given the inability of the EMU to generate a long-term fix to this problem, there’s very little reason to doubt why that won’t happen in the case of Spain and Italy.

Every day that they leave this battle in the hands of the bond vigilantes is a day they’re losing the battle. Today is no exception. Yields in both Spain and Italy are just shy of their highs. Keep a close eye on these charts (which can be found here and here). They are the most important charts in the world today.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.