James Hamilton unearthed a pretty interesting tool from NYU Stern that helps calculate the systemic risk of specific financial institutions. He recently described the process that NYU uses to generate their results:

“The first step that Engle and colleagues propose is to calculate what they call the Marginal Expected Shortfall (MES) associated with a given financial institution. This is an estimate, based on recent dynamic variances and correlations of observed stock prices, of how much the stock valuation of a given institution would be expected to fall today if the overall market were to decline by more than 2%. This is essentially a time-varying tail-event beta, details of whose estimation can be found here.

They next used a dynamic simulation to extrapolate from the MES an estimate of how much the stock would fall in the event of a full financial crisis, defined as a 40% decline in a broad market stock index over a space of 6 months. They estimate this number to be around 18 times the daily MES.

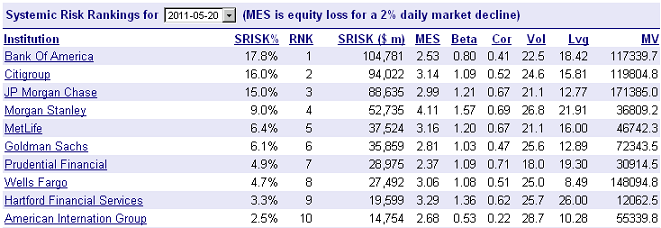

The last step is to compare the magnitude of the decline with the firm’s current equity and liabilities, and calculate how much more capital the firm would need to raise in order to remain solvent in the event of another financial crisis. This measure, which they describe as the “systemic risk” associated with the firm, can either be reported in terms of how big the shortfall of that firm would be (in billions of dollars), or in terms of the percentage of the shortfall across all financial firms contributed by that single institution.”

Most interesting is the backtesting of the tool. Hamilton shows the results from August 2008 and finds that the systemic risk measures showed Fannie, Freddie, Lehman, Merrill and AIG ranking highest on the list. Obviously, that couldn’t have been much more spot-on.

So, what does the list say today? It looks pretty different from the way it did two years ago and most interestingly, it’s all the too big to fail banks which now pose the greatest system risk. So, all we’ve done is shuffle the risk around and congregate it in our largest institutions. If another financial crisis were to hit in the coming years there’s a very real possibility that it would be far more catastrophic than the last one.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.