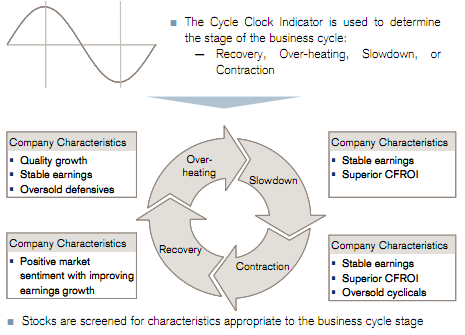

Credit Suisse says the economy has moved into a contraction cycle. And that means portfolio require adjustment. They use a cycle clock indicator to determine their equity allocation based on the performance of particular sectors during various portions of the business cycle. Based on their work, they provide 11 names that are consistent with a slower growth environment:

“We underline that markets are already pricing in a Contraction phase, and as such, we resist a “knee-jerk” change in asset allocation. More specifically, over the past 7 Contraction phases, equities have on average underperformed bonds by 10% in the six months up to the beginning of a Contraction phase, while cyclical equities have underperformed defensive ones by 8% over the same period, although this underperformance tends to start reversing in the six months after the Contraction period starts.

“In this respect, we highlight our balanced approach to equity sector strategy – and the neutral tactical and positive strategic views on equities as stressed by the Investment Committee.

This week’s recommendation is about quality, relatively safer companies, which tend to perform fairly well in an environment of slower growth. Beyond the usual reasons for defensiveness, we recently found that investing in quality, safer companies is actually a profitable strategy, especially over longer-term investment horizons. For this Research Weekly publication we have selected 11 “quality” stocks from the consumer staples, health care and telecommunication sectors, which look fundamentally attractive over a 6–12+ month investment horizon, but also look interesting on a shorter-term horizon (1–6 months): Baxter, General Mills, Gilead Sciences, KPN, Novartis, Pfizer, Roche, SABMiller, Tesco, Vodafone and Wal-Mart.”

Source: Credit Suisse

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.