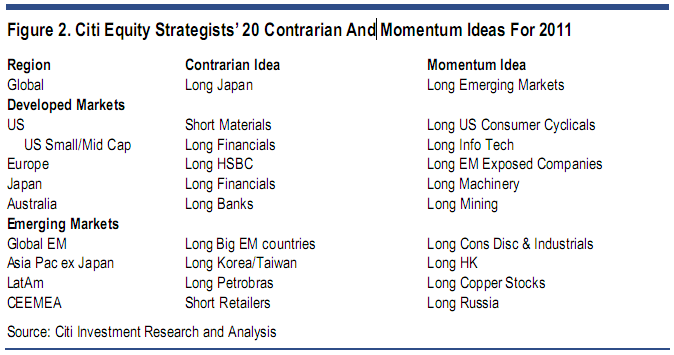

CitiGroup recently polled 20 equity strategists for their best contrarian and momentum ideas for 2011. The ideas (in the chart below) generate a nice diverse global long/short portfolio (via Citi):

“It’s the time of year when we are asked to give our predictions for the next 12 months. In that spirit we asked Citi equity strategists around the world to each suggest their best momentum and contrarian trades for 2011.

We requested one of each to avoid the natural temptation to fill best idea lists with contrarian calls Q buy trades that have gone down a lot or sell trades that have gone up a lot. These might grab investor attention, and pay off spectacularly in big turning point years (like 2009) but momentum strategies tend to work better in more average mid-cycle years (like 2010 and, we expect, 2011). So we would probably expect a better success rate amongst our colleagues8 momentum ideas. Nevertheless, there should still be some good successes to be found amongst the contrarian calls. And remember, when contrarian trades win, they tend to win big.

Figure 2 sums up the suggestions. It offers a wide spread of (mostly long) ideas. Amongst the contrarian calls, Citi’s strategists seem to favour Financials, where share price performance faded in 2010 after a spectacular 2009 rebound. Amongst the momentum ideas, there is a clear Emerging Market tilt, either directly (stay long the MSCI EM index) or indirectly (buy European stocks with EM exposure, buy Australian Miners, buy Japanese Machinery stocks).”

Source: Citi

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.