I came across a pretty alarming article on several large financial websites explaining why it is smart to borrow against your home’s equity to purchase stocks (MSN actually removed the article, but you can read it here at Yahoo Finance).

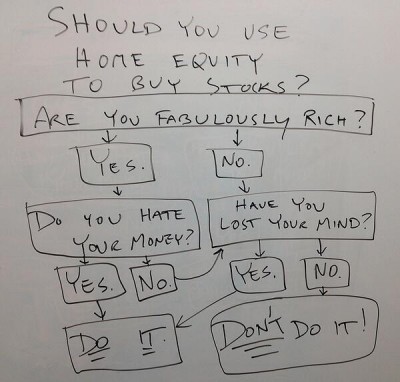

Mark Gongloff had the best and most succinct response to the article posting this flow chart:

Herb Greenberg also had a very good response here. And the always practical Jason Zweig was quick to remind us that equity REITs (the author’s product of choice for your leveraged stock purchase) only fell 60% in 2008.

But let’s take a more serious look at the author’s original three claims because I think this is an important topic since so many people were engaging in this sort of behavior prior to the financial crisis.

Claim #1 – The first is that it diversifies the core value of the largest asset of most Americans.

This is actually true. For most Americans their house is the most valuable asset they own. So spreading some of your personal portfolio out into other assets will likely diversify your portfolio. BUT diversification is not necessarily a free lunch. Leveraged diversification can substantially increase the risks within your portfolio. And that’s precisely what buying stocks with borrowed money does. It substantially increases the risk of your personal portfolio. Leverage is extremely dangerous even for the most advanced investors. The average investor shouldn’t even consider leveraging their portfolio to own volatile assets like stocks even if it adds some diversification.

Claim #2 – There are many stocks that have dividend yields higher than mortgage rates.

Frankly, I am sick and tired of hearing about “dividend paying stocks” as if they’re the same thing as bonds or necessarily make your portfolio “safer”. Common stock that pays a dividend does not give it the same properties as a bond. It does not necessarily protect you from permanent loss risk like most bonds. In fact, high dividend paying stocks are often the riskiest stocks around. Take the iShares Dividend Select ETF during the crisis. This fund buys nothing but high dividend paying stocks. And it got smashed during the financial crisis as it fell 64% from the peak. But hey, at least you were getting 3-4% in dividends along the way, right?

Claim #3 – Stocks are much more liquid than real estate.

The author claims that increasing liquidity in your portfolio will improve your portfolio by ensuring that you can sell the assets ” when needed”. Then the author concludes the article stating that this is a good strategy for “long-term investing”. So I don’t know what he’s trying to say here. You want to own the liquid asset so you can sell quickly if necessary, but you also want to maintain a long-term perspective which implies you shouldn’t sell if the market goes down substantially. That works most of the time. The people it doesn’t work for are the ones who are leveraged up and get margin calls that turn them into forced sellers – usually at the worst time.

The bottom line – this is terrible advice. I am sure most Pragcap readers will laugh at this article, but do me a davor and spread it around. And if you know someone who takes this sort of advice even remotely serious then talk some sense into them because even people who hate their money or have lost their mind don’t deserve to be involved in such a stupid way to lose money.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.