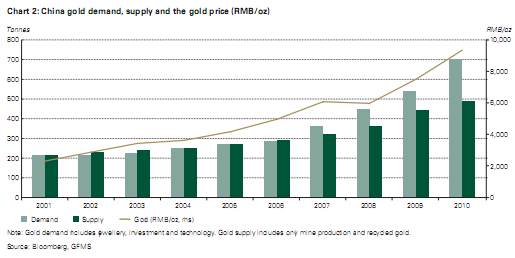

The most recent World Gold Council’s quarterly report showed a continuing boom in gold demand from China. China has been the single most important component in the 10 year commodity boom and their demand for gold is no exception. In fact, this makes a great deal of sense. You see, many of the hyperinflationary concerns that we often hear about in the USA are real viable threats in China. China really is printing loads of money. They really do have a high inflation problem. China really is a command economy. Add in the strong fundamental underpinnings in the Chinese growth story and you have a pretty solid thesis leading to increased gold demand.

In the report, they list 7 reasons why gold demand is likely to remain strong in China:

1) Gold investment is rooted in Chinese culture.

2) Impending inflationary fears in emerging markets.

3) China Central Bank is positive on gold.

4) Limited domestic investment channels.

5) Advisory from top Chinese economic scholars.

6) Increase in asset allocation to gold by institutional investors.

7) Potential increase in gold demand from a growing middle class.

Source: World Gold Council

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.