The smartest investors know that they’re actually not that smart. That is, they recognize the fact that they’re going to be wrong a lot. But in realizing this they also acknowledge a more important fact – they don’t have to be right all the time to succeed. They just have to be right about the right stuff when it matters. Warren Buffett once described this idea at the Berkshire Shareholder meeting:

“Take the probability of loss times the amount of possible loss from the probability of gain times the amount of possible gain. That is what we’re trying to do. It’s imperfect but that’s what it’s all about.”

That sounds like a mouthful, but it’s actually a very simple concept. In essence, you don’t have to be right a lot, you just have to be right about your big bets at the right time. Michael Maubboussin has described this concept as expected value:

“Expected value, in turn, is the weighted-average value for a distribution of possible outcomes. You calculate it by multiplying the payoff (i.e., stock price ) for a given outcome by the probability that the outcome materializes.”

This concept is very well known to good gamblers who understand that they’re playing a negative sum game against the house. But in knowing when to bet big they can increase the odds that they will beat the house. That is, they can increase the expected value of their overall outcomes by knowing when to place the right bets. This isn’t only due to the fact that they make big bets when the odds favor them, but also because they don’t make the catastrophic mistakes that result from betting on things you can’t understand. They not only win big, but they avoid losing big.

While investing is not necessarily synonymous with gambling this idea is crucial to understanding how to implement a successful investment approach. Whether it’s buy and hold investing and understanding that stocks tend to rise over long periods of time or understanding the value of specific firms relative to other firms. Smart investors think in terms of probabilities and not certainties.

Importantly, this isn’t about knowing what will happen. It’s about understanding the world for what it is and applying some reasonably high probability outcomes to certain events. I know, with a high probability that stocks will tend to become more valuable over the long-term because I know that human beings tend to become more productive over the long-term. Of course, we don’t invest in a “long-term” world all the time. In fact, most of us don’t really have a textbook “long-term”. As Keynes once said:

“this long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task, if in tempestuous seasons they can only tell us, that when the storm is long past, the ocean is flat again.”

Saying that stocks will tend to rise over the long-term is not nearly as useful as some might think because our financial lives are a series of short-terms inside of a long-term. In other words, our investment time horizons tend to be multi-temporal. This forces us to think in some version of the “short-term”. And this is where predicting the future gets difficult. After all, over short periods of time the fluctuations of the market become increasingly random. For instance, if we look at the daily, monthly and annual returns of the S&P 500 over the last 60 years we can see just how much time impacts our portfolio outcomes.

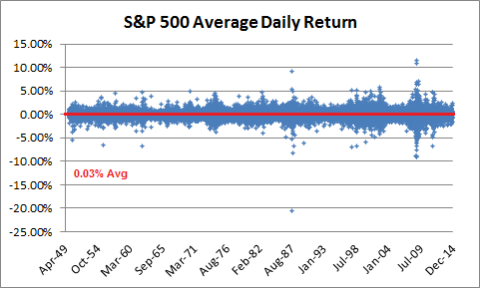

In the very short-term, the stock market is almost entirely random with daily fluctuations averaging just 0.03%:

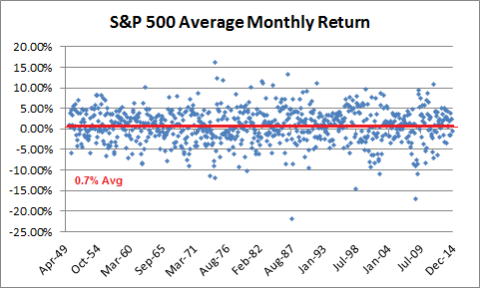

On a monthly basis the average return skews marginally positive to 0.7%, but still appears to be largely random:

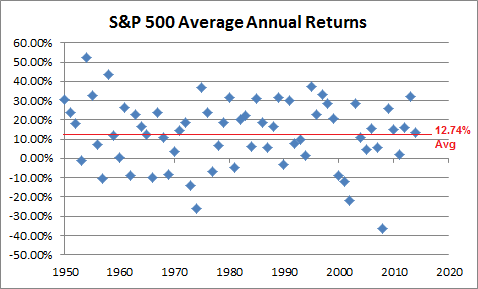

Over an annual basis the average return jumps significantly to almost 13%. The returns still appear somewhat random, but they have a significant positive skew:

Increasing your time horizon reduces the randomness of the stock market’s negative performance because what you’re really doing is improving the odds that your portfolio’s performance will correlate with broader corporate output. So, it’s not really about not being able to predict the future. It’s about understanding how the world works and then applying high probability outcomes to future events. This is not about “knowing nothing” or avoiding predictions. It is very much the opposite. I would argue that the more you know the greater the probability that you will make high probability predictions about the future.

Of course, smart investors also know their own limitations. They know the limits of concepts like “the long-term”. They know the limitations of ideas like “the short-term”. They know the arithmetic of the market and the importance of reducing taxes and fees. They understand the futility of trying to “beat the market”. And they know that the stock market isn’t where you get rich. As GI Joe taught me many moons ago, knowing is half the battle. The other half is applying your knowledge in a manner that is likely to result in a high probability of you meeting your financial goals.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.