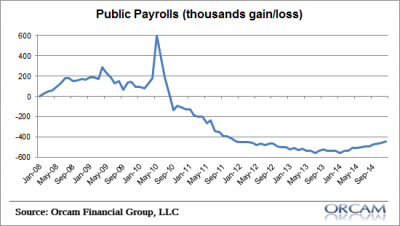

One of the more remarkable elements of the current economic recovery is the degree to which government employment has shrunk. Typically during a recovery the government expands alongside the private sector. But since 2008 government employment has shrunk by 443,000 jobs:

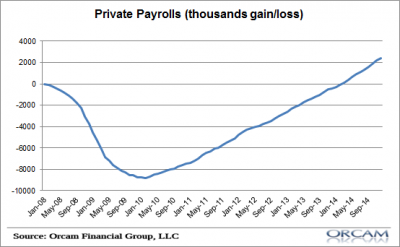

Private payrolls, on the other hand, have boomed since 2008 gaining over 2,400,000 jobs:

It would be interesting to be able to explore the alternative universe where, if we hadn’t gotten scared into believing the US government was going bankrupt or turning into Greece, that maybe we would have held onto many of those jobs, paid less in government unemployment benefits and instead actually gotten some productive output out of the employed. My guess is the economy would be doing a bit better in that alternative universe, but politics over the impending mythical default of the US government appears to have led to some poor decision making in recent years.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.