Christmas comes 4 times a year for the real nerds in the finance industry. The most important accounting statement in the world is issued by the Federal Reserve once a quarter. The Z.1 report is a comprehensive overview of the most important macro trends in the US economy. Here are some general conclusions:

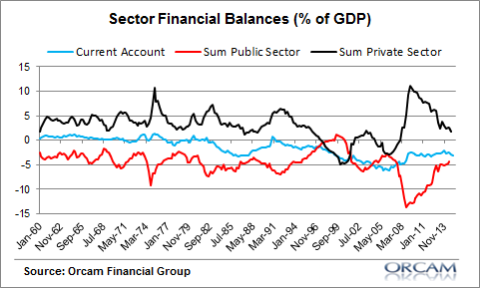

1) Sectoral Balances Points to Private Sector Led Recovery.

We can understand the major contributing sectors of the economy by looking at the sectoral balances. We know that these sectors must sum to zero at any point and that the private sector tends to be at its healthiest when it’s operating in a surplus relative to the other sectors.

The flip side of this is that the public sector safety net tends to be reduced as we get deeper into recoveries. Recovery leads to increased private sector expansion, increased private sector confidence, the potential for a boom and the boom sows the seeds for the bust. And when the bust comes the public sector usually ends up picking up the slack. So, it’s a good sign that the private sector is running with the baton here, but we should acknowledge that that is also a sign of an environment that could be ripe for increasing instability.

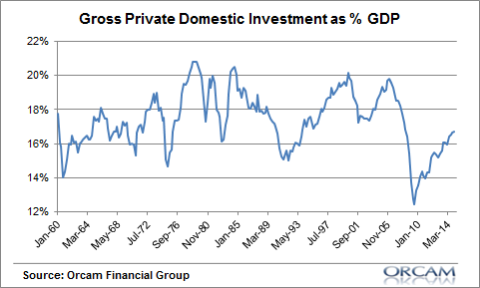

2) Private Investment Is Back to Average Historical Levels.

Private investment has climbed back just shy of its historical average of 17%. There’s been a lot of chatter about how little corporations are doing to contribute to the recovery, but corporations have been one of the main drivers of this recovery. Those who predicted that the 2013 austerity would lead to a recession were wrong primarily because they underestimated how healthy private investment was and how healthy corporate America was.

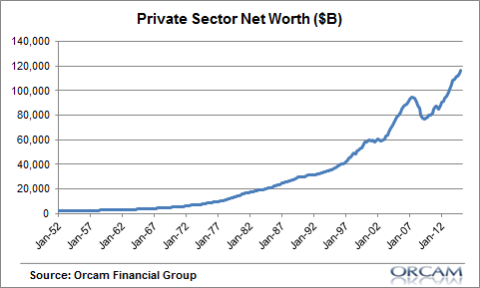

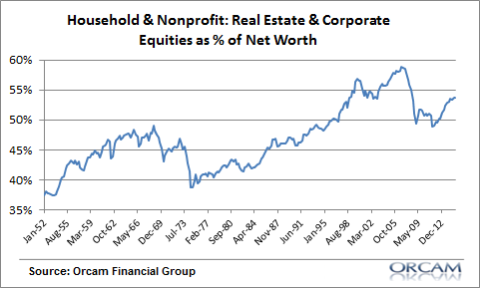

3) Private Sector Net Worth is at an All-time High.

Private sector net worth has climbed to an all-time high on the back of rising corporate valuations and real estate.

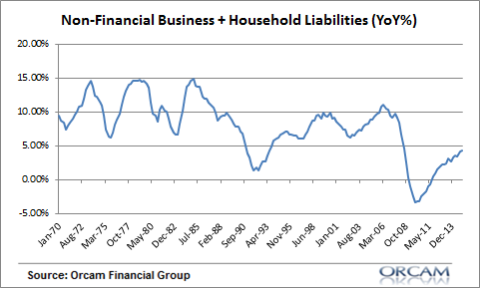

4) The massive debt that the government inherited in 2009-2013 allowed the private sector to take on less debt than is typical without torpedoing growth.

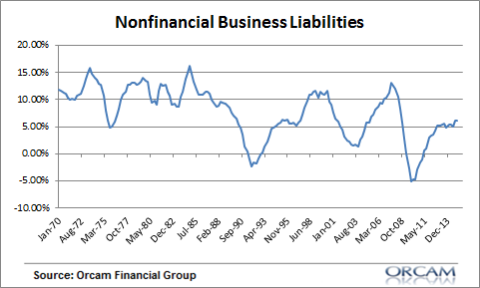

We’re slowly crawling back to normalized levels in debt growth. Although households remain very weak corporations have also picked up the slack there. Debt growth, however, remains very low relative to past recoveries and this explains why this has been a weaker recovery than we’re used to.

5) The discrepancy in household debt accumulation and corporate debt accumulation has been tremendous during this recovery.

The chart below shows that corporate debt has climbed almost back to its historical levels and is actually growing at a healthy rate of 5%. Household debt, on the other hand, is growing at just 2.5%. The consumer still feels rather weak here. As I stated several years ago, the Balance Sheet Recession is over, but the negative impact still remains to some degree.

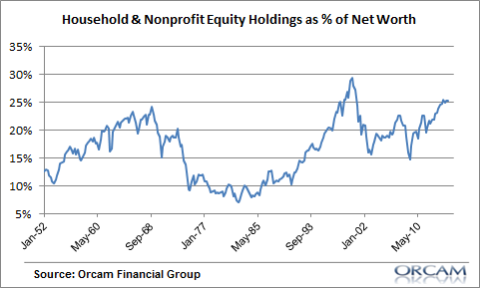

6) The economy is becoming increasingly dependent on the stability of asset values.

This is due to the massive growth in real estate and equity markets over the last 30 years. As a percentage of net worth these components of the balance sheet are becoming increasingly important. And in markets that can be volatile that directly translates to economic volatility. Given the high valuations and high asset levels as a % of net worth in these markets it is going to be increasingly important to build diversified portfolios that are insulated from the potential for increasing financial instability.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.