Sometimes I feel like I’ve been writing the same articles here for the last 7 years. Oh wait, I know why that is – it’s because that’s exactly what I do sometimes. This might meet Einstein’s definition of insanity except for the fact that I keep saying these things because it is clear that many people simply don’t learn from their mistakes. Take Alan Greenspan for instance. This is a man who wrote a piece in 2010 saying that the US government was somehow analogous to Greece. I explained a million times (see here, here and here) back in 2010 how this comparison was operationally wrong (basically, Greece can’t print Euros while the USA can). How does one make such a colossal misjudgment and not explore how that view was wrong and ultimately correct it?

Instead of learning from this mistake it looks like Alan Greenspan appears to be doubling down on his comments this morning in a Bloomberg interview. He says:

“We have a pending bond market bubble. If we merely substitute the structure of equity prices and we have the price of bonds and instead of expected equity returns we use expected interest rate returns that price earnings ratio is an extraordinarily unstable position. And what will ultimately determine where it goes is to look back in history and ask what is the normal interest rate.”

I just don’t think this is right. As I explained back in 2010 his whole model for comparing Greece and the USA was wrong. It was wrong to compare the USA to Greece because Greece is essentially a user of a foreign Central Bank’s currency. We saw how true this is in the last few weeks as the ECB cut of emergency funding to the Greek banking system and almost bankrupted the entire economy. So, Greenspan had the operational understandings wrong there and that’s why his 2010 comparison between the USA and Greece never came close to panning out.

It was worse than that though. Greenspan’s assumption on interest rates was that high government debt would necessarily lead to higher interest rates. But this is not necessarily true during a time when the private sector is deleveraging as we’ve seen during the last 7 years. Greenspan wasn’t looking at the aggregate economy and instead chose to make a political point about high government debt levels. There is no necessary causal relationship between high government debt and high inflation or interest rates. Especially in a country where much of that debt is foreign held or held by the domestic Central Bank.

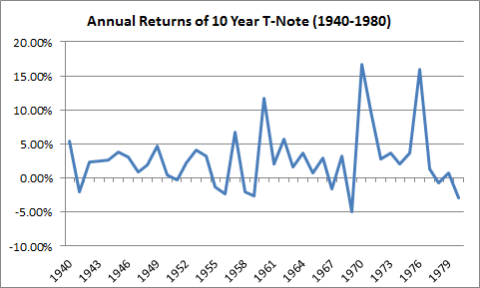

Greenspan’s more recent comments are equally confusing. What makes this environment in bonds “bubbly? Yes, I referred to the bond market coming into this year as frothy, but “bubble” implies something much more dangerous as I’ve explained before. After all, bubbles pop and when they do they leave a mess behind. But is the US government bond market really a “bubble” today just because of low interest rates? Not necessarily. And we have some history on our side to explain this (apparently not the same history Greenspan is using). In the period from 1940-1980 interest rates were very low starting at about 2% on a 10 year note. They rose steadly into the high teens from there. And over this period you generated an average annual return of +2.65% (that’s POSITIVE 2.65%). Of course, your real return was lower, but you earned this low nominal return and got your principal back at maturity. You didn’t lose a dime in nominal terms. And the worst annual loss was just -5%! This was not remotely comparable to anything like the Nasdaq “bubble” or the housing “bubble” where investors experienced significant principal losses.

I’m sorry to keep rewriting some version of the same articles. And I am even more sorry to make this sound personal with Mr. Greenspan, but I don’t think he’s doing anyone any favors by constantly spreading what sounds like a political message as opposed to one based on operational realities and historical facts.

Related:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.