We were late in the business and market cycle and the global economy looked shaky. Emerging market stocks cratered 40%. Commodities fell over 25%. The dollar rallied over 20% against most major currencies. Asia looked liked it was falling apart. No one knew what the impact would be in the USA and stocks seemed to hang in there for a while, but then they suddenly fell 18%.

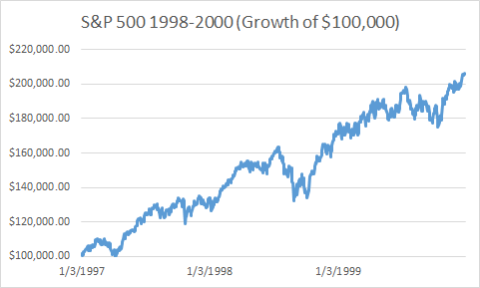

No, I am not describing the current environment. This was 1998. It was eerily similar to the current market environment. And you know what happened next? The US economy went on to have one of its best years ever. The very next year GDP grew at its best rate of the recovery and the economy looked so strong that US stocks went into an irrational bubble as they surged 54% in the next 18 months before ultimately succumbing to the tech bubble.

Of course, this isn’t 1998. There are significant differences between then and now, but one thing that’s eerily similar is the fact that emerging markets, which drive just 14% of S&P 500 sales, will not derail the US economy. Is it different this time? Of course. It’s always different this time. But the only similar environment in modern economic history can still serve as a decent guide to the future.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.