Here are some things I think I think – technology is making the world a better place, odds of recession & the bears get trolled by Wall Street analysts.

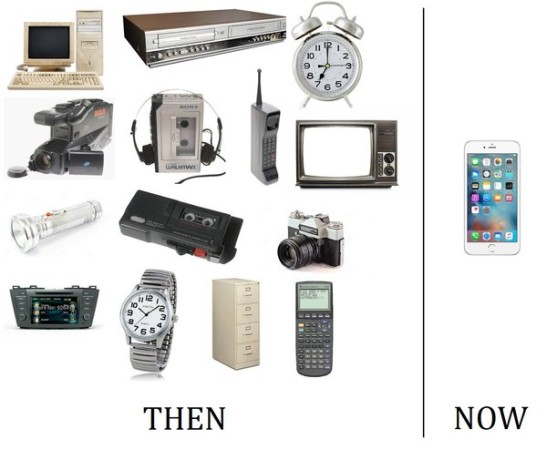

1 – Are Living Standards Really Stagnating? I was intrigued by this piece in the NY Times by Tyler Cowen arguing that American living standards have stagnated and that technology hasn’t helped. I know that median wages have been stagnant, but is that really the best measure of living standards? I mean, living standards are a pretty particular thing and I don’t think making more money necessarily means the world is getting better. For instance, I posted this image on Twitter yesterday showing the technological advancement of the last 20 years:

I said it a few weeks ago and I’ll say it again – if Silicon Valley had produced just ONE thing in the last 15 years, the smart phone was enough to make living standards dramatically better. The person making $40,000 in 2001 would have to spend tens of thousands of dollars to acquire all of these technologies and now purchases all of them in a pocket sized device that costs a few hundred dollars.

Now, I know there’s more to life than tech gadgets, but I find it hard to believe that technology hasn’t contributed substantially to improving living standards….

2 – 100% Chance of Recession this year? Here’s Jim Rogers saying there’s a 100% chance of recession in 2016:

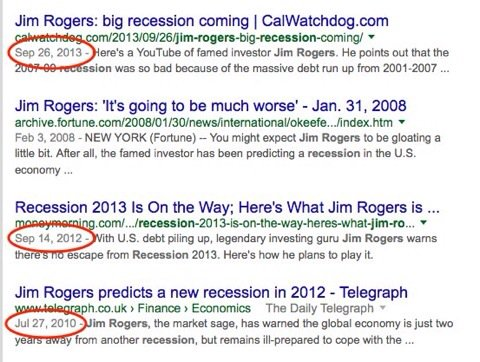

Daniel Crosby finds a problem with this prediction:

Hmmm. I guess if you predict a recession every year then you’ll eventually be right….

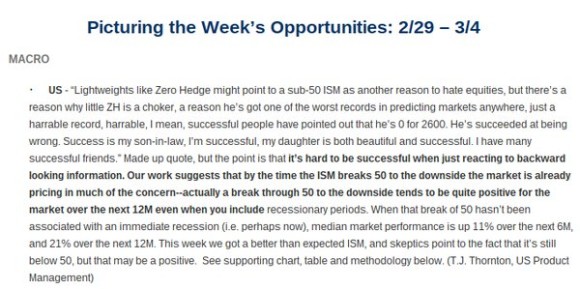

3 – The Bears get Trolled by Wall Street. Speaking of permabears – here’s a hilarious note from Jeffries analyst TJ Thornton channeling Donald Drumpf:

Perfect. Enjoy your weekend. If you find yourself needing to read an extremely nerdy financial paper don’t miss my newly published paper at SSRN.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.