Alright Millennials, listen up – I am older than you and that means I am smarter than you so take a few minutes and soak up this old man’s knowledge bomb or I will put you into a choke hold and noogie you until you scream mercy.¹

Here’s an article by a millennial telling other millennials to “save” in Bitcoin. It’s an intriguing bit of advice that can be boiled down to this:

- Fiat money is bad and is designed to hurt your purchasing power.²

- Stocks, bonds and real estate are all super expensive.

- Crypto and Bitcoin is a new and empowering form of asset that can help offset points 1 & 2.

I get it. A lot of millennials feel priced out of this economy and they’re frustrated. But there’s no free lunch here. Let me explain.

Your savings is the residual of your unspent income. This is money you hold onto for some future need. For most of us it means we keep a small amount in savings to cover monthly expenses and then stockpile larger amounts to account for larger purchases in the future (a house, a car, a vacation, etc). And then you have your long-term savings which is basically your retirement stash.

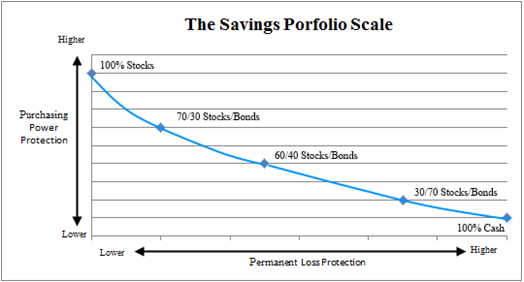

Now, most of this savings needs to be pretty stable because life is unpredictable and you don’t want your savings to be so volatile that you can’t predict how you’ll be able to afford things in the future. But at the same time, you need to take some risk with your savings because you need it to beat the rate of inflation and grow over time. To visualize how assets can be applied to that you can see this scale:

In a general sense, stocks are instruments that protect you very well against the risk of purchasing power loss, but in the process of doing that they will also expose you to significant permanent loss risk at times. Cash, on the other hand, will protect you against the risk of permanent loss, but will also expose you to significant purchasing power loss over time. Bonds are kind of in the middle. When you’re saving money you need to build a portfolio that does a little bit of all of that. So it’s generally better not to be too far on either extreme.

Bitcoin is a different beast entirely. Let’s focus on a few important points about Bitcoin:

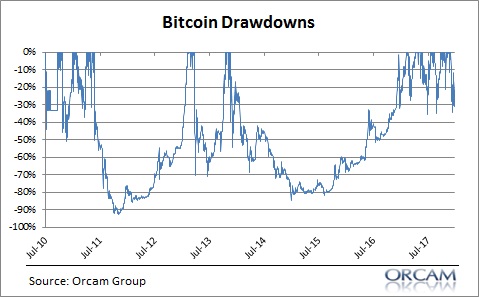

- Bitcoin is an unbelievably volatile asset. This is an instrument that has lost 80% or more of its value twice in the last six years. It has lost 30% or more of its value 9 times in the last 6 years.

(This. Is. Crazy.)

2.Further, Bitcoin’s utility as an actual financial instrument is unproven and limited at present. Current market prices are pricing in a lot of optimism, but there are only a few hundred thousand transactions per day in Bitcoin. It is far from a reliable and important payment system.

3. There is a non-trivial chance that it could go to $0. At this stage in the game there’s a very real chance that Bitcoin is a deficient version of a decentralized payment coin. There are numerous other options that could displace Bitcoin as the dominant payment coin.

Also, it’s important to note that Bitcoin is denominated in USD. The reason for this is because Bitcoin is not a dominant medium of exchange with a stable settlement value. So, when you want to go buy something you have to transfer your Bitcoin into USD. The same basic point is true of stocks and bonds. Stocks and bonds aren’t accepted as a medium of exchange because they don’t settle at par every day. They are too volatile for retailers to accept and manage the price risk around. So they demand cash and deposits.

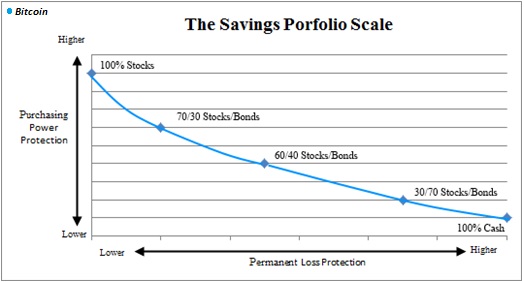

So if you had to add Bitcoin to the Savings Portfolio Scale it would literally be off the charts. There is a chance this thing is the greatest store of value in history. And there is a chance that it will wipe you out regularly. The key point is that your “savings” is designed to be stable and while Bitcoin might generate positive returns in the future it is unlikely to do so in a stable manner.

Personally, I think of Bitcoin as an early stage equity investment in a decentralized payment system. It is essentially a form of equity in a payment system, the utility of which is totally unproven and unknown. Lots of people have optimistic opinions about it, but the truth is that no one really knows how this is all going to play out. Granted, it’s fine to make a bet on something like that, but you have to keep it all in the proper perspective.³ And let’s be clear – “saving” in Bitcoin might be appropriate for a small amount of your portfolio that you don’t mind losing, but we really should not compare it to the type of saving that is done in proven cash flow generating assets such as stocks, bonds and cash.

Don’t worry Millennials. You guys are going to be fine. Many of you are building world changing technologies and will continue to invest in yourselves in ways that will make the older generations look like a bunch of unproductive dopes. Keep doing it. And keep allocating some of that savings in smart portfolios like many of you are doing with Robo Advisors and other low fee services. It’s fine to take some risks, but you don’t need to get caught up in the mania and do crazy stuff. And if you keep investing in yourselves, saving, allocating that savings prudently, etc. then one day many of you will be writing articles to younger generations about how best to prudently invest and save because one day you’ll be the richest generation this country has ever seen.

¹ – Many (most?) Millennials are smarter than I am, but as “an old” I know it’s my responsibility to scream at Millennials and make them feel bad about themselves until they overtake us all and make the generations below them feel bad about themselves. That’s how this works, right?

² – A lot of these anti “fiat money” arguments (like the hatred of debt) in the crypto space are based on vast misunderstandings about how money and economics works. They tend to veer in the same direction as the rationale for gold as money, which, if you’ve read Pragcap for long enough, you know is a bunch of horse shit.

³ – A very simple approach to owning Bitcoin would be to allocate it based on a Global Financial Asset approach as a market weighted value of a portfolio. So, if Bitcoin is currently 0.5% of all outstanding financial assets then maybe that’s the amount you personally own. This way you’re essentially making an efficient market bet on the market weight of Bitcoin relative to everything and if Bitcoin grows substantially then it will become a larger and larger part of your portfolio that positively contributes to your portfolio.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.