The recent craziness in Gamestop has resulted in a lot of hot takes on short selling. I have the hottest takes, of course, so let’s dive into this a bit deeper and put this debate to rest.

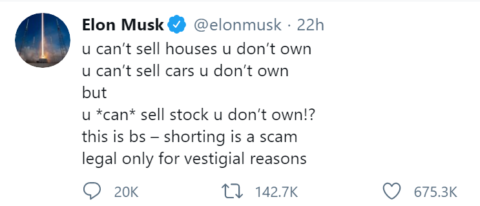

Here’s a piping hot take from the richest man in the world:

Wow. That kinda makes sense. But wait, does it really? No, Cullen, stop. Back up. Let’s explain how this works first. Just so we’re all on the same page.

Short Selling Basics. This whole convo kinda reminds me of the buyback debates or the national debt debates or the money multiplier debates. You know, the types of debates in finance where 95% of the popular narratives are based on a misunderstanding of the first principle basics of the things involved. So, let’s all get on the same page here about how this works.

If you want to bet on XYZ stock going up in value you can buy it outright. So you enter an order to buy $100 of XYZ stock and you simultaneously sell $100 of cash to someone because you think that cash will be worth less than the stock in the future. Someone else was betting that XYZ wouldn’t go up in value so they were willing to sell you their $100 of stock in exchange for cash, which they thought would be more valuable in the future. That’s super clean, right? But what if you didn’t own that stock and wanted to bet that it could go down? You can actually borrow that thing and sell it to someone else with the hope that it goes down in the future. Doing this involves the same basic principles as the purchase, except we’re borrowing something into existence. In this case we’re borrowing the stock and selling it to someone else (let’s call them the “short buyer”) who wants to buy it with the hope that we’ll be able to buy it back in the future at a value that more than covers our borrowing costs. Interestingly, if you want to own a stock and you don’t have the money you can actually buy it on margin effectively creating money to buy stock with something you don’t own (the money).

Now for short selling more specifically – if there are 1,000 shares of XYZ outstanding and you borrow 500 of those shares to sell them short then someone is long 1,000 shares, you are short 500 shares and someone else is newly long your 500 share short. There are still only 1,000 shares outstanding and you have a negative 500 share balance while two other investors have a positive 1,500 share balance. If the stock falls in value more than your borrowing costs then you’ll be able to book a net profit. If this is starting to sound a little bit like any old endogenous money supply expansion then you’re right. It’s very very similar and as regulars know there’s nothing inherently nefarious about balance sheet expansions. Balance sheet expansions are just part of our every day economic activities.

Ban the Short Buyers?

On that note, it’s interesting to circle back to Elon’s tweet because the whole economy revolves largely around selling things we don’t actually own. For instance, when Elon builds a Tesla he borrows money he doesn’t own. And he sells that money he doesn’t own to buy some supplies he doesn’t want to own. And he puts those supplies into a car he doesn’t want to own. And then he sells all that stuff to someone else who does want to own it with the hope that, by the end of the transaction he’ll have covered his borrowing costs all along the way. And the person who buys that car often buys it on credit with money they don’t own. Boy, doesn’t that all sound a lot like short selling? Elon’s effectively short debt. He’s short his own supplies. He’s short his own cars. He doesn’t really want to own any of this stuff! He must be an evil guy!

Of course, that would be a ridiculous statement. There’s nothing inherently evil about the action of selling something just like there’s nothing inherently good about the action of buying something. And that’s a big part of the misunderstanding here. There is a buyer for every seller. There is a seller for every buyer. Yes, short sellers are selling a thing. But they are also creating a short buyer in the process. Is that short buyer a hero? Is she also evil because she’s involved in this short selling transaction that is supposedly so evil? Of course not. The point is, there are buyers and sellers in every market transaction and a lot of economic activity involves people using things they don’t own to buy/sell other things they don’t want to own.

Anyhow, all of this is a little more complex than that. After all, intent and impact matters. And if short sellers are hurting legitimately good businesses then that’s kind of a problem. It is actually very similar to a long buyer colluding with other buyers (some of whom are borrowing a thing they don’t own, money, to achieve this) to drive the price of a company higher which then benefits that company in a manner that disproportionately benefits it and hurts their competitors along the way. You know, kinda like people driving up Gamestop stock and giving their owners and investors the ability to cash out or sell new shares to investors that might have otherwise been beneficial to firms that do something that, you know, doesn’t involve grown men sitting around in their parent’s basements watching a TV.¹ I tease, but again, there are buyers AND sellers here. The buyers are no more altruistic in all of this than the sellers and they can also have bad intents that hurt certain people.

The thing is, capital markets exist so that firms can raise money and savers can allocate money to assets that diversify their savings. This is good! But when the value of those assets become wildly volatile and detached from their intrinsic value then we have a problem because that hurts certain firms and individuals at the benefit of the people/firms who are potentially causing that price discrepancy. This is true on both the long side and the short side. After all, a pump and dump scheme is far more common than a short and distort scheme because it’s a heckuvalot easier to pump and dump a stock than it is to short and distort. But you don’t have people out there screaming about pump and dump schemes saying “we need to ban buying!”² The point is, every single person pumping the price of Gamestop unsustainably above its intrinsic value is involved in something that is just as harmful as every person who dumps the price of Gamestop unsustainably below its intrinsic value.³

In the end this all kinda becomes a debate about efficient markets. Does short selling distort price discovery? Does it actually hurt the underlying business? I am inclined to argue that it does not distort anything in almost all cases. That’s because stock markets are mostly secondary markets. That is, they’re just a place where stocks trade after all the actual investment has been done (firms raising money and actually spending it). Those stocks just reflect the underlying business to some degree and the firms mostly don’t care who owns their shares and the markets don’t impact the actual companies all that much. That is, a secondary market is a lot like a horse track with betting. The horses run the actual race and the bettors do stuff that reflects the value of those horses. But the bets don’t actually make the horses run faster or slower. Buying a stock long or shorting a stock is very similar.

Further, has there ever been a legitimately great business that failed because of short sellers? Because that’s really what this is all about. If you run a great business that is wildly successful then people are gonna want to own that business if you’re selling it. It won’t matter how much some people are borrowing and shorting because the intrinsic value of the underlying business will drive demand on the long side that forces all these shorts out of their positions in the long-run. So, a lot of this debate seems to put the cart before the horse. Or, as Warren Buffett might say, the market is a voting machine in the short-term and a weighing machine in the long-run. If you run a good business in the long-term there is no amount of short-term short selling that can alter the intrinsic facts around the underlying business.4

¹ – Don’t get me wrong. I love my mom. And if I could make millions of dollars playing video games in my mom’s basement I would seriously consider that. It sounds pretty nice actually.

² – There’s an actual rule called the “uptick rule” that makes it very difficult to force a stock lower. Basically, a short sale can only be executed on an uptick. So the short seller can’t “hit the bids” as they say and force the price lower. They have to sell at the asking price which makes any manipulation much more difficult to enact.

³ – We often hear that short selling is bad because we shouldn’t root against business growth. That’s bullshit. Some businesses suck. Lots of businesses do shitty things to make money. Either way, we bet against things all the time. I will root against all of your children when they play against my daughter in anything. I will root against your sports team when they play mine. Heck, I might even bet against them using money. Shit, I might even use some money I don’t own to bet against them. You get my point. Don’t mess with my daughter or I’ll torch you.

4 – A lot of this is basic math. As I’ve described before, short selling is really really hard because you’re swimming against a strong tide. Most publicly traded firms are already somewhat successful. People wanted to own their shares publicly. That’s why they went public! And given the unfortunate math of a short sale (limited upside and infinite downside) you create a highly asymmetric long-term bet that can only go in one direction if you run a good underlying business.

NB – This topic has been covered in detail by researchers following the financial crisis and its many short sale bans. They found no evidence to support the bans. In fact, they found it often degraded market quality:

- How the Australian Ban on Short Selling Impacted Stocks.

- Market Declines: What Is Accomplished

by Banning Short-Selling

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.