One of the interesting things about going through the process of building an asset management company is that you can get bogged down in the regulatory weeds about the meaning of specific words. I’ve discussed the general nature in which the finance and economic industries (mis)use terms like “money” or “passive investing” in ways that render them virtually meaningless. But the biggie I’ve come across more recently is the concept of “global stock market capitalization” – the total actual value of global stocks. This was particularly interesting in the process of building my new company Discipline Funds because we had to be very precise about what these terms meant. As I navigated the process I realized that the regulatory meaning of these terms is highly conflicted and often vague, by necessity. “Global stock market capitalization” was especially interesting for me because it became apparent that this term has some controversial underpinnings that can result in extremely different views on asset allocation. Views that have very important implications for how people are exposed to certain stock market risks.

This controversy goes way back and is still being hashed out in many ways. Indexing companies have competed and struggled with the concept for a long time as markets have evolved, become more open around the world and the demand for global indexing strategies increases. I won’t rehash the whole history, but the basic gist of the controversy at present is this:

- There are 82 stock exchanges around the world.

- These 82 exchanges have a total market capitalization of $122T.¹

- You cannot buy all $122T of that market capitalization because it is not investable.²

- Most indexing strategies give you access to a relatively small amount of the full stock market cap.

Now this is where things get really interesting. FTSE and MSCI do a very nice job of quantifying the “investable” free float of the global stock market. Publicly available funds like Vanguard Total World and MSCI All World are based on these calculations. Out of that $122T FTSE and MSCI quantify that approximately $67T is investable. In other words, these funds do not give you exposure to almost HALF of the world’s stock market capitalization. The primary reason for this is that a lot of the global stock market is not “free floating” meaning you cannot actually purchase the shares on a secondary market. This could be due to things such as illiquidity, regulations or insider/government ownership.

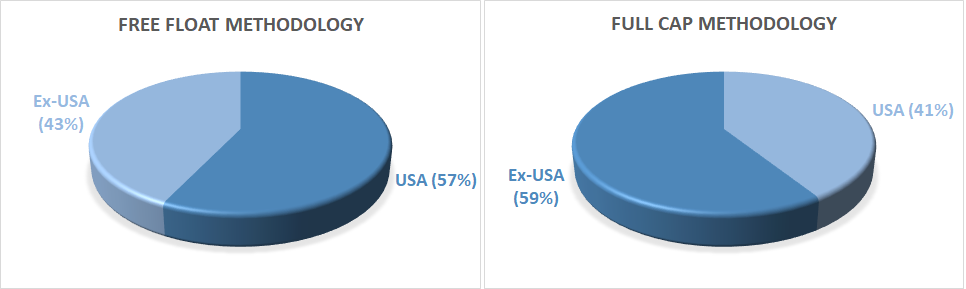

This is an astounding realization in my view for several reasons. One reason is that we’ve always been told that the US stock market is exceptional. Not just in terms of its performance, but also in terms of its relative size. The interesting thing is that, depending on how you define “global stock market capitalization”, the US stock market is not nearly as big as we think. If we use the actual full market capitalization the US stock market is just 41% of global equities. But if we use the investable universe methodology then the US stock market is 57% of global equities. This means that most investors who hold large global stock funds are much more overweight the USA than the actual market capitalization. Maybe I am just a big nerd, but I find it astounding to consider that the US stock market could be 16% smaller than some methods assume.

What is perhaps even more interesting is that the size of emerging markets are dramatically understated depending on how we measure this. I talked with Elroy Dimson, Mike Staunton and Paul Marsh, who informed me that the overall weighting of emerging markets would DOUBLE if there were no index exclusions, liquidity restrictions, and free-float adjustments. If you thought that US weighting was astounding then this figure is mind blowing.³

All of this has huge implications for asset management and the way we build global stock portfolios. If we use one methodology we’re way overweight USA while the other results in an underweight. Additionally, if you use the full cap methodology you have to accept that your non-US full cap exposure doesn’t exactly correlate to the actual foreign slice (because so much of it is not investable). But the alternative is to have an overweight US position that doesn’t accurately reflect the actual issuance of global equities which leaves you potentially overexposed to home bias and/or specific country risk. What’s the right answer? I am not really sure to be honest, but being way overweight US stocks just because of a subjective definition leaves me a little uncomfortable.

Now, I am not saying that it’s wrong to use “investable” universe. This makes a good deal of sense. But it’s especially interesting in the context of recent regulatory developments and government policies. For instance, the Federal Reserve has purchased $5.5T of US Treasury bonds. Should a bond investor adjust their bond portfolio to account for this quantity that has been removed from the investable secondary market? I don’t know. I guess maybe that makes sense? I guess maybe it does not. Or what about the hundreds of billions of dollars of equities that the Bank of Japan has purchased or the Swiss National Bank? Again, I don’t know the best way to account for this stuff because there are very reasonable arguments for doing it multiple different ways. The definitions are necessarily subjective. Personally, I am more inclined to use the actual full cap instead of the free float because those instruments actually exist even if they’re not “investable”. But I understand the alternative argument as well.

Maybe this helps you better understand why I have been weirdly obsessed with debunking terms like “passive investing”. The ramifications are important because they can substantially impact the way we understand the financial markets around us and the way we apply asset allocations to those markets.

NB – Thanks to Elroy Dimson, Mike Staunton and Paul Marsh at London Business School as well as Dr. Pedro Gurrola-Perez at WFE who helped me with this data.

¹ – Source: World Federation of Exchanges

² – “Investable” has varying definitions ranging from literally cannot be purchased (such as government held assets) to difficult to purchase (markets that aren’t easily accessible and liquid).

³ – Source: Dimson, Staunton and Marsh, Credit Suisse Global Investment Returns Yearbook 2021

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.