As I get older I am trying to do a better job of seeing both sides of all arguments so I am not tone deaf to the very real problems that a lot of people have, that all of us might not have. And here’s one that I hope you’ll help me out with because I don’t know if I have the right answers for it.

Here are some interesting stats about the current state of affairs:

- GDP – all-time high

- Stock prices – all-time high

- Real estate prices – all-time high

- Household net worth – all-time high

- Corporate profits – all-time high

These are amazing statistics given where we were just a year ago.

But here are some even more amazing statistics:

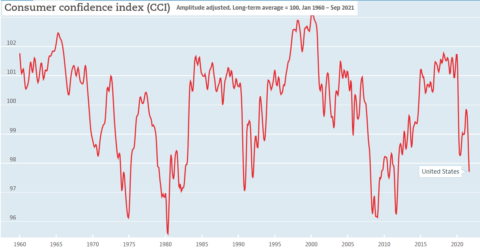

OECD USA Consumer Confidence Index

Gallup US Economic Confidence Index

These are dreadful polling numbers. So, what gives? I don’t really know to be honest. My best (most obvious) guess is:

- The recovery has mostly benefited the poor and top 1% while many in the middle feel left behind.

- Highly visible prices like food and gasoline have risen A LOT. And while it makes sense to strip out food and energy for the sake of getting smoother data readings, regular people value these things because they’re high frequency costs which, irrational or not, disproportionately impact sentiment.

- And then you have the record sized government interventions of the last few years which left a lot of people saying “we locked down the economy for 18 months, spent almost $14 trillion and all now my margarita costs 30% more.”

It could just be that COVID has people feeling down and that’s bleeding into economic sentiment. But I think there’s gotta be more to this sentiment so I’d love some feedback on this and what people are feeling.

NB – The title of this post is a joke, but something I genuinely believe to be true across longer time horizons even if it’s not exactly true in the last 24 months.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.