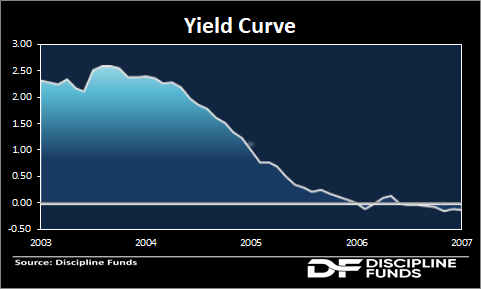

John Authers has a fantastic piece in Blomberg discussing the return of the Greenspan Conundrum. This is something I’ve mentioned many times in the last few months. I won’t try to rehash all of his points because he does a far better job than I can do. But for those who are too young to remember, the Greenspan Conundrum occurred when Alan Greenspan raised interest rates during the housing bubble. The Fed hiked overnight rates from 1% all the way to 5% and the 30 years Treasury Yield moved NOWHERE. It just sat there at about 5% for the entire period until the curve inverted and the economy eventually crashed. Greenspan was confused by this “conundrum”.

I’ll never forget that moment. I was in San Francisco for Christmas and I watched CNBC announce the very instant the curve inverted. I turned to my wife and said “well, this usually means one helluva recession is coming”. I had no idea how big it would actually be.

The current twist on the conundrum is this:

- Virtually all prices are rising at an uncomfortable pace, including, gulp, house prices.

- The Fed is getting worried about all of this and has started discussing potential rate hikes.

- The long end of the curve has barely budged.

It feels an awful lot like the 2000’s scenario where the Fed will want to raise rates, but if they do they risk inverting the curve and crashing the economy. But this time, if they start raising rates they don’t have 5% of wriggle room before they invert. They have barely any room at all. As of now it looks like the long end of the curve seems to be staunchly in the “inflation is transitory” camp which means that Conundrum 2.0 looks to be on the table here.

It’s an interesting exercise in portfolio theory and forecasting because the intuition in an environment like this is that bonds have to lose money since inflation is rising and the Fed wants to raise rates. But as we learned in 2008 and then again in 2020, the exact opposite might be the case when the Fed raises rates. The Fed might be on the verge of crashing other asset prices which would, ironically, result in bond prices surging. So, at the exact moment when it looks like a no-brainer to sell bonds, the opposite might be true. No wonder markets are so hard to predict….

Crazy times. Who knows what’s coming down the pike? More reason to diversify and not have excessive exposure in any particular place.

Related:

Bonds Do Not Necessarily Lose Value When Interest Rates Rise.

Do Bonds Still Diversify When Rates Rise?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.