Here are some things I think I am thinking about:

1) Good bye Transitory, we barely knew you.

Jerome Powell says the Fed should “retire” the term “transitory”. I like the sound of that. As I said back in July:

“My view is that they should stop using this term entirely and try to more accurately communicate inflation and its likely future paths.”

This term was always confusing because people perceive inflation as price changes. When gas goes from $3 to $4 and then to $4.25 the Fed would say the inflation was “transitory” because the rate of change slowed. But all we see is that gas used to cost $3 and now costs $4.25. It might have been transitory in some textbook academic sense, but it wasn’t transitory in my “real world” model.

Don’t get me wrong. It’s the rate of change that actually matters for the purpose of Fed policy. But part of Fed policy is communicating things to the public so that they actually understand and trust your process. This term created a counterproductive narrative that was overly confusing. Good riddance.¹

2) Things are starting to look…transitory.

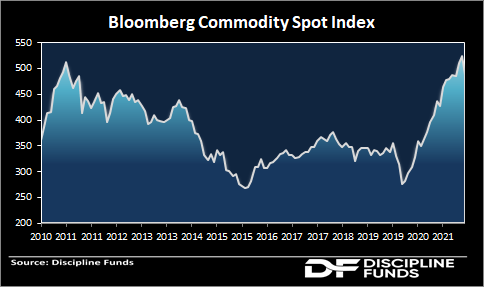

It’s funny that the Fed is choosing to retire the term transitory right when things are starting to look increasingly transitory. For example, commodity prices just had their biggest monthly decline  since the pandemic began. Commodity prices are flat since July and up just 2.3% since May. This is significant since commodity prices are one of the best real-time inflation readings and impact the economy so broadly. It’s also consistent with a lot of other data we’re starting to see where inflation trends are slowing.

since the pandemic began. Commodity prices are flat since July and up just 2.3% since May. This is significant since commodity prices are one of the best real-time inflation readings and impact the economy so broadly. It’s also consistent with a lot of other data we’re starting to see where inflation trends are slowing.

This data does not bode well for people who predicted hyperinflation in October. In fact, I am increasingly willing to bet that peak inflation fear occurred at the exact moment that Jack Dorsey predicted hyperinflation. This doesn’t mean we can’t or won’t continue to see inflation. I’ve been very clear that we’re going to see 6%+ CPI readings well into 2022. But the odds are rising fast that by this time next year the inflation picture will look much more subdued. In other words, the time to be really worried about inflation was 2020. Not 2022. Markets are forward looking. Don’t get caught flat footed.

3) Cullen is transitory.

Some personal news – I am travelling for the first time in forever. I’ll be in NYC next week and would love to meet up if you are around. Shoot me an email. If you’d like to avoid me that’s also fine.

¹ – I would consider working for the Fed as the Director of Communications under two conditions – 1) I don’t have to leave San Diego and my chickens. 2) I get a not so transitory salary.²

² – Just kidding. Half the people reading this already think I work for the Fed and if I actually took a job at the Fed that would instantly unravel the credibility of the guy who posts blog posts with Homer Simpson all over the place.

NB – Here’s what I said in May of 2020 on inflation:

“the government is basically going to print four, five, six trillion dollars of new financial assets and liabilities that aren’t necessarily supported by anything new, there aren’t even new houses being supported by all of this so this money is being created out of thin air and being spent and financed and we’re basically just paying people to sit around and do nothing for the most part to stay home literally so it’s a really weird environment to think about just because you have all these supply chains that are being cut off and the basic math of basic monetarist view of supply and demand here is that you inevitably…I don’t see how there can’t be some inflation that comes out of this I’m not you know I’m not like transitioning into like a hyperinflation sort of mentality but I don’t see how there’s any chance that coming out of like say 2021 or 2022 that if the economy is really rebounding that we don’t have three, four, five percent [core] inflation and I think you could have the Federal Reserve chasing their own tail raising rates.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.