1) The Competition for Worst Ideology is Heating Up

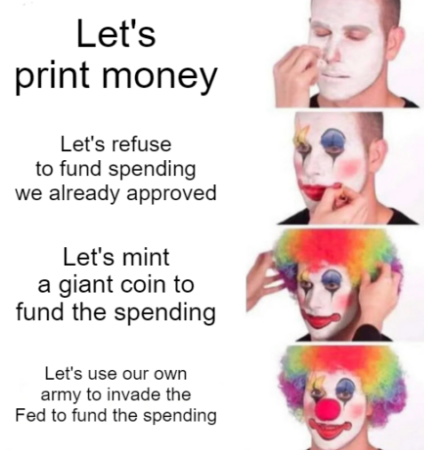

There’s a battle of bad ideologies going on around the debt ceiling debate. Unfortunately, this is a microcosm of what has happened in American politics – the centrists have been silenced as both fringes scream over them. And it’s the fringe thinking that gets all the attention these days.

In the case of the debt ceiling we’ve got fringe thinkers on the right actively threatening to let the USA default on debt. And on the other side you have an equally crazy response where MMT advocates are saying we should send the military to the Federal Reserve if they don’t accept their trillion dollar platinum coin concept.

That’s the state of discourse in the USA. It’s gotten so bad that we have to resort to minting a trillion dollar platinum coin and then sending the military to the Fed to defend this idea. It would be funny if it wasn’t seriously sad. I posted this meme on Twitter to get a laugh, but maybe I should be crying?

Where are the adults in the room? As I’ve explained in the past, the debt ceiling is silly and does nothing except allow extremists to hijack the default narrative. But this response to fighting crazy with even crazier is…well, crazy. It’s time to stop playing games with the USA’s credibility and silence these extremists.1

2) Interest Rates Don’t Do Anything?

Monetary Policy has many transmission mechanisms. As regular readers know, I think some of these transmission mechanisms are very powerful. Others, not so much. For instance, I tend to view QE as being far less impactful than the “money printing” narratives that are often associated with it. Changing interest rates, however, is widely supported by academic research as being very impactful.

So I’ve been surprised at how many people keep saying that changing interest rates doesn’t do anything. In fact, some people seem to think raising interest rates boosts economic growth. Which is an especially strange narrative given that we now know that housing is slowing substantially in large part due to interest rates. As Liz Ann Sonders from Schwab shows, a steep slowdown in economic growth is always consistent with this level of home sales declines.

So the real test here is the counterfactual where the Fed hasn’t been so aggressive and instead allows housing to slow at a more gradual pace. How much stronger would the economy be in that environment? I guess we can’t know for sure, but it’s hard to argue that it wouldn’t be substantially stronger.

And more importantly, if Monetary Policy acts with long and variable lags then who’s to say that the housing slowdown isn’t just getting started? After all, we’ve barely seen prices budge….

3) Is Retirement a Raw Deal?

I talked about the FIRE movement in my latest FAQ video. FIRE is the idea that we should seek financial independence by maximizing our income, saving an unusually large portion of it and investing in low cost diversified index funds. I love the premise. I always tell people that you need to invest in yourself, optimize your skills, optimize your income and save enough to be able to consistently allocate into low cost and diversified portfolios. That’s all great. But should we really seek to retire early?

I increasingly loathe the idea of retirement. And so this article from CNBC really resonated with me. The basic gist of it was that when people retire they lose their sense of purpose and feel lost. This certainly isn’t true all the time, but I see it more often than I like. And I wish there was a better solution because retirement causes a huge amount of angst for people.

In general, I don’t love the idea of trading our 40 best years in life to a corporation in exchange for 20-30 years of freedom where we’re breaking down. I think people should try to target a better glide path into “retiring” so that they can maintain hobbies or skills that allow them to earn an income well into their old age where they still feel like they have a purpose. I know, easier said than done and I am painting with a pretty broad brush here, but it’s food for thought.

1 – Interesting historical fact. The trillion dollar coin idea actually came into the mainstream in large part due to THIS website. Back when we had a comment section my friend Carlos Mucha, an Atlanta attorney posted the idea. I talked about it quite a lot back in 2011 and 2012 when this was a big debate, but I was mostly joking. I didn’t actually think we’d ever need it. And I certainly didn’t think we’d still be having this silly debate 10 years later!

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.