By Jordan Roy-Byrne, CMT at The Daily Gold:

This post is a sample of our premium work. It comes from today’s premium update.

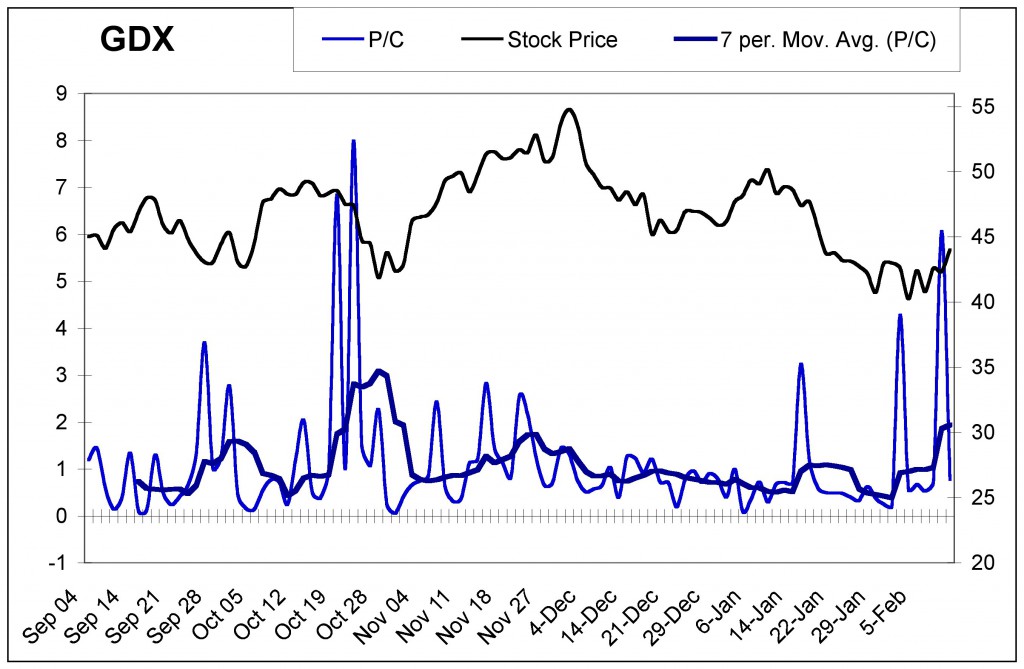

We track options data (put-call ratios) from the International Securities Exchange. Their options data provides a better contrary indicator than options data from the CBOE. Below is a chart of GDX along with the put-call ratio from the ISE. Rising put-call ratios or spikes tend to provide bullish signals when they occur after a market has been falling. We use this data in conjunction with regular technical analysis. Note that the put-call spikes at the end of October signaled a bottom in GDX. We think the same thing has just happened now.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.