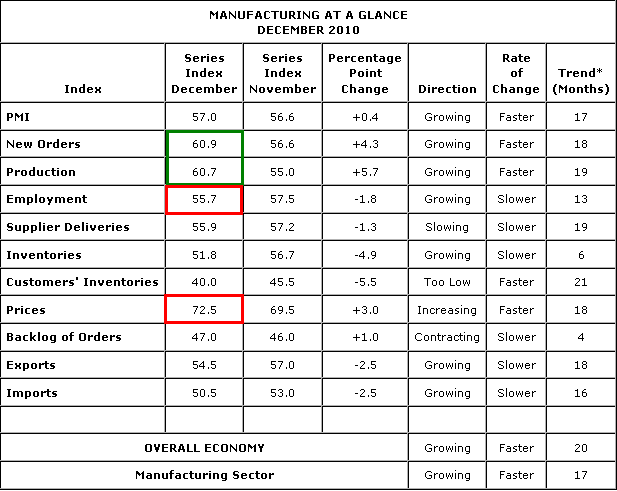

This morning’s ISM report got 2011 off to a very bullish start. The headline figure came in at 57 versus expectations of 57.2. This was a slight disappointment compared to expectations, but a look under the hood shows a very strong report that confirms what we have been seeing in the recent regional reports. New orders rose to 60.9 while production also surged in the final month of the year. On the downside was a decline in the employment index and a continuing rise in prices. This is generally consistent with the economy of 2010 – sufficient growth, but increasing margin pressure which puts a cap on hiring.

Norbert Ore, chair of the ISM had generally positive comments:

“The manufacturing sector continued its growth trend as indicated by this month’s report. We saw significant recovery for much of the U.S. manufacturing sector in 2010. The recovery centered on strength in autos, metals, food, machinery, computers and electronics, while those industries tied primarily to housing continue to struggle. Additionally, manufacturers that export have benefitted from both global demand and the weaker dollar. December’s strong readings in new orders and production, combined with positive comments from the panel, should create momentum as we go into the first quarter of 2011.”

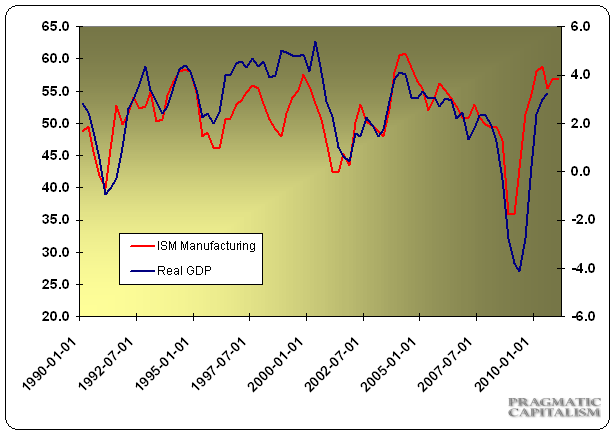

Despite the decline in employment this is just one more positive sign from recent data that the economy is gaining and sustaining momentum. Current ISM levels are consistent with real GDP growth of just under 4%. Assuming these levels are sustained we could see further upside surprises in the economic data as most analysts are well shy of 4% growth on the year.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.