As austerity sets in on the periphery of Europe mainly (thanks in large part to the flawed currency system) there are increasing risks that a double dip could develop. Of course, many of these nations remain mired in deep recessions or depressions and the recent bailout packages all involve harsh austerity measures that will certainly keep them on their knees for years to come. As the problems in Portugal, Spain and Italy evolve there is the potential for even greater austerity and forced pain in the EMU. Meanwhile, the core nations have largely recovered, however, there are signs of weakness.

In a recent strategy note the always excellent Michael Darda, Chief Economist of MKM Partners detailed the reasons why he is becoming increasingly concerned about a Eurozone double dip:

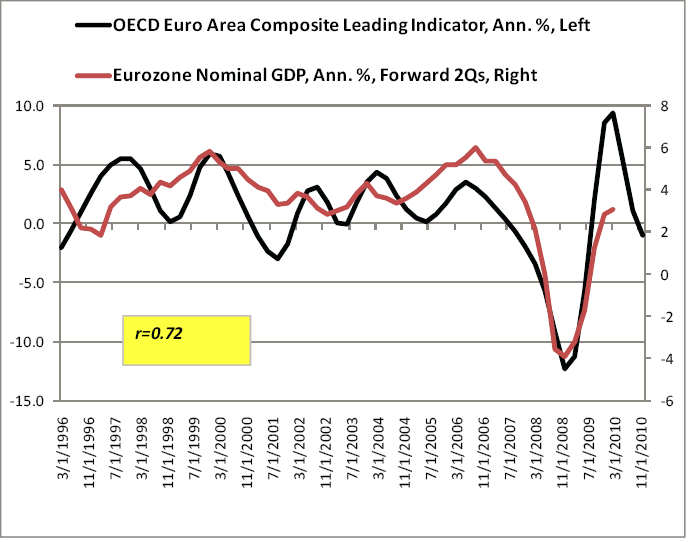

- Leading indicators in the Eurozone have rolled over. The OECD’s Euro Area Composite Leading Index has declined for seven consecutive months:

- Euro-area monetary aggregates are weak across the board. Both M1 (narrow money) and M2 (broad money) are contracting on a three-month annualized basis in the Eurozone;

- However, euro-area business confidence is nearly back to peak 2007 levels. Despite the ongoing struggles, business confidence is high in the eurozone. However, confidence levels tend to be elevated at cycle peaks and depressed at cycle troughs;

- Weak money growth and strained credit markets suggest a high risk that the euro-area nominal GDP recovery could be stopped in its tracks. Absent a powerful positive shock to the velocity of money, European nominal GDP growth is likely to slow sharply;

- Debt spreads in Spain and Italy are showing a troubling pattern of “higher highs and lower lows”. Despite backing off a bit recently, sovereign debt spreads in Spain and Italy are near record highs. Worryingly, each successive “peak” in spreads has been higher than the previous one while each“trough” has also been higher.

- One way out of this mess would be for the ECB to expand its balance sheet more aggressively, but it’s not doing so. The ECB’s balance sheet (the asset side of the monetary base) is growing at less than half the historical average despite wide credit spreads, contained inflation expectations and weak broad money growth. There’s even talk in some circles about the ECB tightening policy this year.

Warren Mosler, Founder and Principal, III Offshore Advisors, elaborated on the Darda commentary:

“No question austerity will work – that is, it will force negative growth. Question is just when. Unless they make fiscal adjustments, but that seems unlikely.

I’m starting to feel a deflationary malaise coming on as the end of year/beginning of new year related activity subsides.

Headline CPI increases to me are mainly just relative value shifts that rob demand for other things,

and are not anywhere near pushing through to core measures which would pass them on to indexed compensation.But the talk of inflation is just one more thing keeping global authorities thinking they don’t need another ‘fiscal stimulus’ as they continue to push spending cuts and ‘fiscal responsibility’.

Housing going nowhere. Jobs going nowhere as GDP growth only marginally exceeds productivity growth.

Financial sector finding it hard to make a buck as loan demand remains weak and competition is driving down net interest margins and spreads in general. (I’m thinking of holding a walkathon to help them out. Anyone want to kick in a few cents a mile?)”

The world is at an interesting stage of economic growth currently. The United States has done just enough to muddle through and generate positive economic growth though not enough to substantially close the output gap and get the country anywhere close to full employment. China and much of Asia, on the other hand, initiated severely misguided fiscal packages during the 2008 downturn that now appear to be substantially contributing to their inflation woes and potential overheating. Europe, on the other hand, has been mixed with the core benefiting largely at the expense of the periphery. Austerity measures on the periphery are creating deep economic holes and the potential is for the problems to worsen as the likelihood for aid in Portugal, Spain and Italy increases in the coming months and years and only worsens the austerity virus. Europe remains a divided economy with the core recovering and the periphery still in recession. If the problems in the periphery worsen or even fail to improve there is an increasing likelihood that the growth on the core will weaken and Darda’s concerns will come to fruition.

Source: MKM Partners

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.