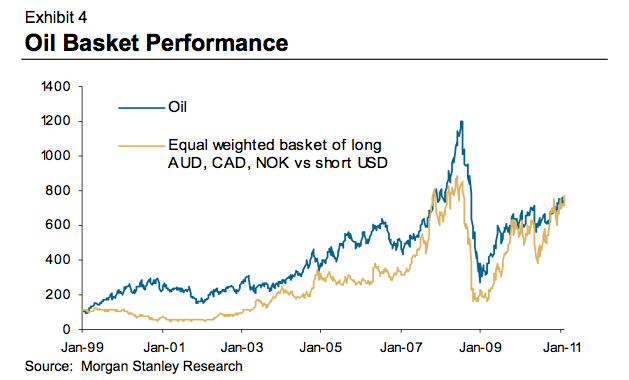

Great chart here from Joe Weisenthal at Business Insider. It shows the equal weighted basket of various currencies vs the dollar and overlays it with oil prices. As you can see, there is more than one way to gain exposure to oil price gyrations. The correlation is a near perfect 1:1.

This is interesting from a risk management perspective because it gives a fairly novice trader a decent way to hedge against oil/commodity price moves without having to take a direct position in a futures contract or unreliable oil ETF. Currencies tend to be less volatile than commodities so can serve as a way to gain exposure with reduced risk. For instance, when the price of oil declined 70%+ in late 2008 the Canadian Dollar declined just 22%. The Aussie Dollar fell just 30%. In the current environment a currency pair can be a great way to place a tepid short bet against the huge surge in commodities without having to take on the risk of a super spike in a specific commodity…..Obviously, there’s lots of ways to utilize this correlation, but understanding that the correlation exists gives you a nice starting point.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.