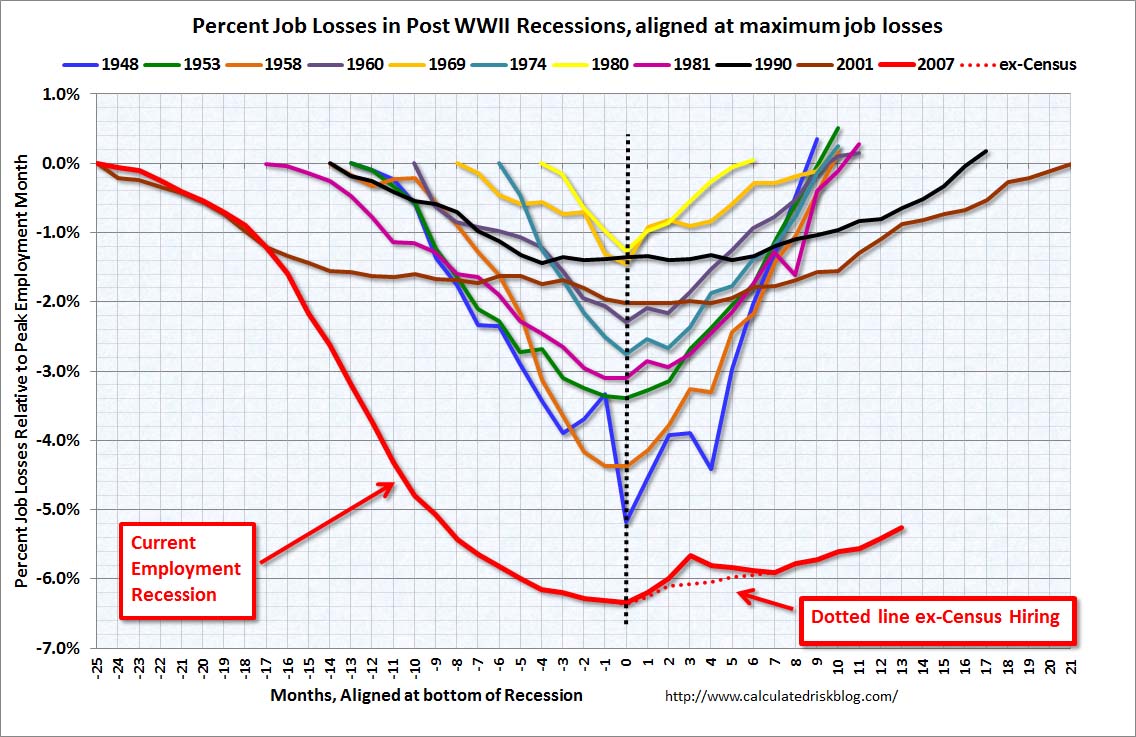

Not to rain on the parade today, but I think some perspective is necessary with regards to the state of the job’s market. In this morning’s note David Rosenberg puts the current situation in the proper context – yes, we are recovering, but this is still one disastrously large hole we are climbing out of (via Gluskin Sheff):

“…there is a very long row to hoe for the labour market – let’s not forget that it is still digging itself out of a very deep hole. For example, at 130.738 million, payrolls are actually lower now than they were in January 2000. Think about that for a second – because over this 11 year period of flat employment, the population has risen nearly 30 million. The level of payrolls is also much closer to the bottom than it is to the peak – in fact, here we are heading into year number three of the expansion and only 17% of the job losses have been recouped. (On average, 21 months after a recession ends, total NFP recover 207% of the jobs lost from the recession. There was one exception and that was the 2001 recession, where payrolls didn’t reach the bottom until 21 months after the recession ended in November 2001.

At this state of the cycle, what is “normal” is that we are at a new all-time high on employment! But payrolls are actually 7.25 million shy of where they were when the recession began, so the fact that they have rebounded 1.5 million from the lows is, in the overall scheme of things, really nothing to write home about. Here we are, just three months away from closing the books on the second year of the statistical stimulus-led recovery, and employment is still much closer to the trough than to the peak. If we can luck out and have the business cycle die and escape a recession at some point and continue along the path of 200K payrolls gains month in and month out, then we can look forward to the spring of 2014 before all the losses from the Great Recession are fully reversed.

In other words, let’s hold off on the cheerleading and take umbrage in the fact that the labour market, while on the mend, is still a very sick puppy.”

And Calculated Risk provides the visual:

Source: Gluskin Sheff

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.