The media is clamoring to discuss how today’s consumer credit report means that the household balance sheet is “improving”. But this report shows no such thing. The Fed reported:

“Consumer credit increased at an annual rate of 3-3/4 percent in February 2011. Nonrevolving credit increased at an annual rate of 7-3/4 percent, while revolving credit decreased at an annual rate of 4 percent.”

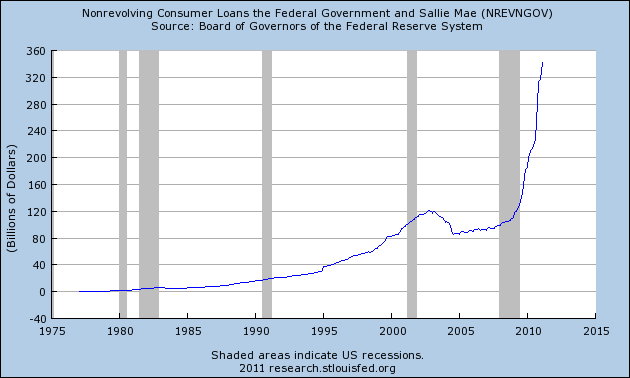

The reality, however, is that the “improvement” is entirely due to the Sallie Mae student loan reclassification. You can see how this program has skewed the consumer credit data in recent years:

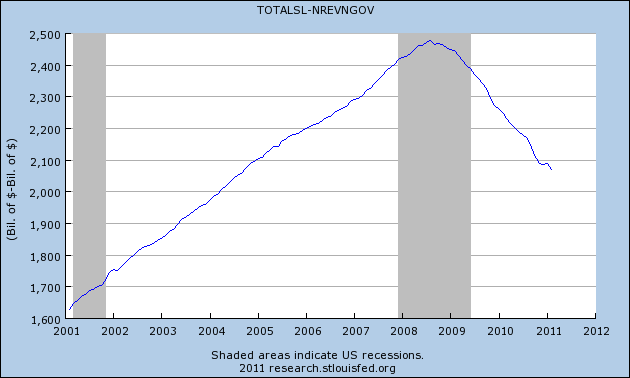

When you back out this segment you can see that the consumer is still in the midst of de-leveraging:

So no, consumer credit is not increasing. Either way, the last thing this economy needs is a consumer that re-leverages. Sure, it might be good for near-term growth, but ultimately it remains unsustainable. The US consumer very badly needs to continue de-leveraging.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.