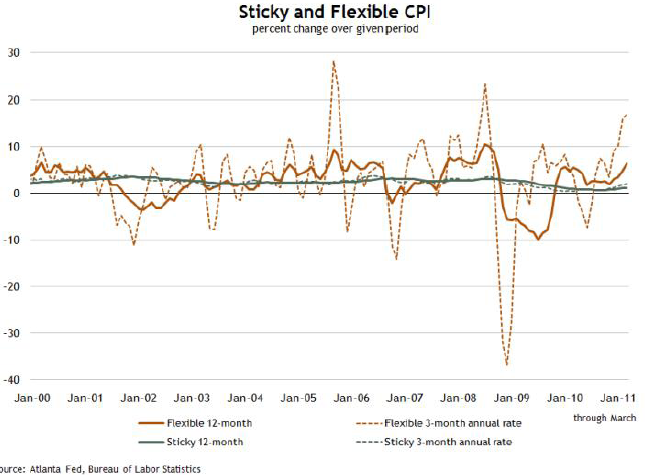

The latest update on the Cleveland Fed’s flexible and sticky prices model:

- Growth in the sticky price measure—the weighted basket of goods consumers purchase that change prices relatively infrequently—rose 1.5% (annualized) in March following a 2.7% jump in February. The 12-month index rose 1.3%, a slight increase from the 0.8% to 1% range seen over the past year, though still below the longer-term trend for the series.

- The sticky price index increased 1.3% (annualized) on a core—excluding food and energy—basis, above recent 12-month trends in the range of 0.7% to 1.1%.

- The flexible cut of the CPI— weighted basket of goods that change price relatively frequently— rose at a 21.1% annual rate and was up 6.4% from year-earlier levels in March. Excluding food and energy, flexible CPI rose 3.8% (annual rate) and is up 1.3% from year-earlier levels.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.