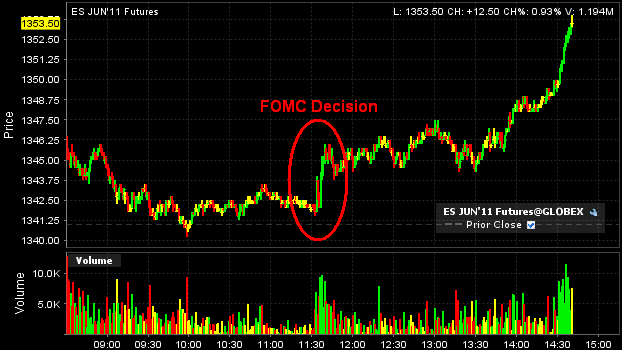

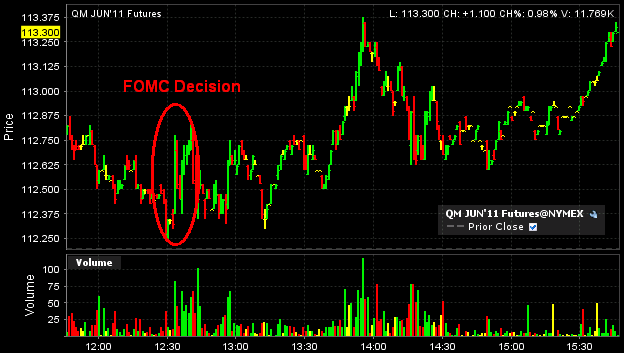

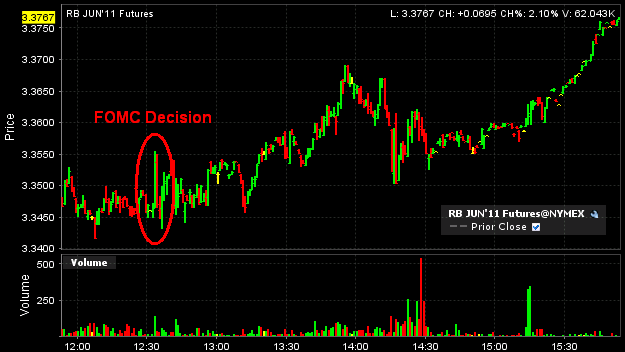

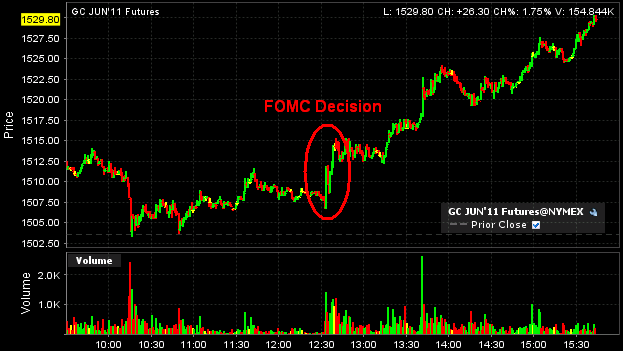

Let’s expand on the previous post regarding event studies. The big news of the day was the Fed’s new transparency due to the Fed Chief’s press conference. But today’s market action provided more transparency into the Fed’s impact on markets than they’re likely comfortable with. In just 3.5 short hours the Fed managed to spark massive speculative rallies in just about every single asset class. While most markets were trading flat before the FOMC decision almost every single relevant market is up over 1% since the decision. The inflection point is pretty obvious in the following charts.

Stocks ripped higher following the assurances that the Fed would remain accommodative

Oil prices rallied almost 1% following the FOMC decision despite a bearish inventory report in the AM.

Gasoline prices rallied 1% following the FOMC decision.

Gold prices surged over $20 following the FOMC decision.

Is the Fed having a substantial impact on gasoline, oil, equity and commodity prices in general? You decide. If I had to guess though I’d venture to say that the SF Fed won’t be issuing any research reports regarding the Fed’s dramatic impact on these markets and the clear connection between the Fed’s commentary and intra-day commodity prices…I think it’s pretty clear that we should probably trust the BOJ’s commodity price analysis over anything the Fed publishes. Anyone with a working set of eyeballs can see that the Fed is directly contributing to the speculative surge in commodity markets (and all markets for that matter)….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.