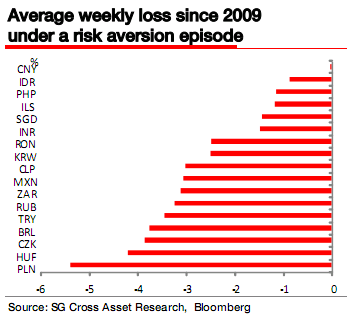

With growing signs of a global economic slowdown and increasing worries over sovereign debt, Societe Generale has recently downgraded emerging market currencies. In this risk aversion play they studied the best defensive emerging market currencies. They found that Asian currencies have proven to be the best plays when taking a defensive posture:

“Heightened sovereign worries, broken trends, softer economic data in mature markets. Against the more hazardous global backdrop, we have turned more cautious over EM currencies.

- We look at EM currencies’ relative resilience to an increase in the VIX index.

- We analyse betas versus EUR/USD and SG Risk Sentiment indicator, correlations with EUR/USD as well as information from the options market.

The conclusion is that:

Asian currencies (notably Taiwanese Dollar – TWD) overall much more resilient than peers (alongside Israeli Shekel – ILS).Meanwhile, Czech Koruna (CZK) is the most defensive CEE currency.

- Asian currencies move less in absolute terms when sentiment shifts and USD moves.

- Asian FX less flexible therefore have some defensive characteristics. Going forward, significant scope for Asian FX to appreciate, with rising inflation risks and overheating conditions.

- Asia prevails again looking at correlations to EUR/USD.”

Source: Societe Generale

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.