This morning’s reading on durable goods was just one more sign of a slowing economy. Econoday provided a brief overview of the data:

“Durables orders fell back in April as overall new factory orders for durables declined 3.6 percent, following a revised 4.4 percent jump in March (previously estimated at up 4.1 percent). April’s decrease was worse than the median forecast for a 3.0 percent fall. Excluding transportation, new orders slipped 1.5 percent, following a 2.5 percent rise in March. Weakness in the latest month was broad-based but also followed a broad-based jump in March. This series is living up to its reputation as one of the most volatile monthly data series.”

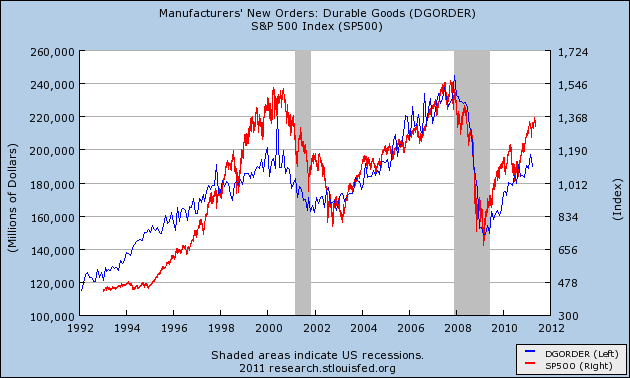

Now, this durable goods data is notoriously volatile, however, it does provide some insight into the equity market. As you can see below, durable goods and the equity markets are very highly correlated. What’s important, however, is that there does not appear to be any real substantive break in the uptrend in durable goods. Because this data is so volatile I think we’d have to see a decisive move to the downside before we could definitively conclude that the equity markets are due for a protracted decline.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.