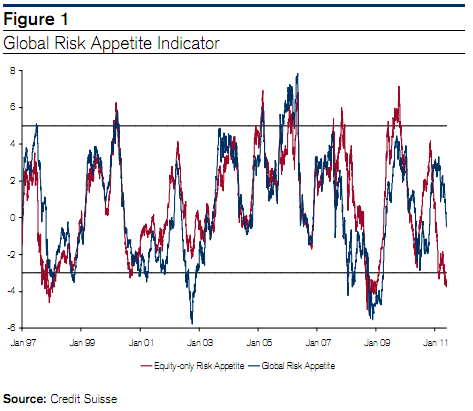

We’re still only about 5% from the recent market highs, but the level of panic appears to be rapidly on the rise. And with good reason. As this morning’s job’s report showed, the US economy remains deep in a funk. There appears to be a permanent cloud over the economy and market psychology in general. Credit Suisse’s Global Risk Appetite Indicator helps investors visualize this. They say we’re nearing a panic point:

“Although the Global Risk Appetite Indicator – often seen as a contrarian indicator – has moved closer to “panic,” we think it is too early to rush into equity markets right now, but our tactical stance implies using periods of temporary weakness to close underweights in equities and to buy stocks in sectors/industries and regions which we recommend.”

Source: Credit Suisse

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.