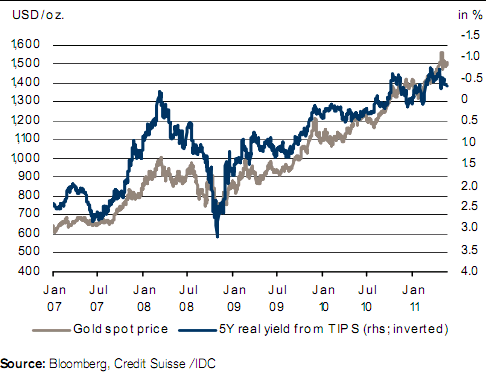

Credit Suisse says the recent economic uncertainty only strengthens the bull case for gold as investors are likely to turn to the precious metal as a safe haven. They maintain that the economy uncertainty will force the Fed to remain very accommodative. This potent mix of uncertainty and low real interest rates creates a very bullish outlook for gold prices:

“Low real interest rates should attract further investment demand for gold. Gold should also benefit from rising uncertainty over the economic outlook.

Gold to benefit from low yield environment. Precious metals benefit from the low yield environment. In particular, gold is less cyclical than other commodity markets and should perform well in the weeks ahead.”

Source: Credit Suisse

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.