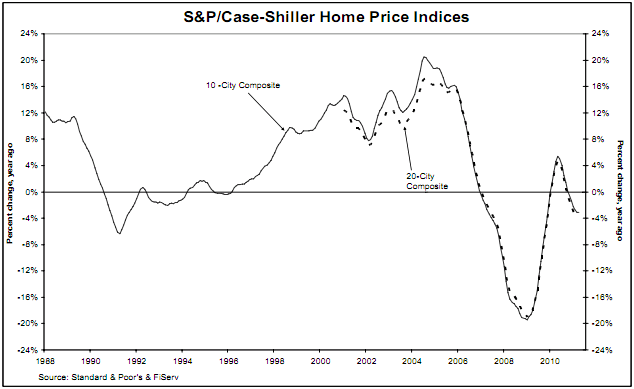

House prices rose 0.7% in April according to the S&P Case/Shiller index. Obviously, residential real estate plays a key role in the balance sheet of American households so this can only be seen as a positive. The rise was mostly due to seasonal effects, but a rise is a rise. The good news is that the double dip may not be as severe as some expected. The bad news is that the structural problems in the housing market mean we’re a long ways from the boom days. S&P details the report:

“Data through April 2011, released today by S&P Indices for its S&P/CaseShiller1 Home Price Indices, the leading measure of U.S. home prices, show a monthly increase in prices for the 10- and 20-City Composites for the first time in eight months. The 10- and 20-City Composites were up 0.8% and 0.7%, respectively, in April versus March. Both indices are lower than a year ago; the 10-City Composite fell 3.1% and the 20-City Composite is down 4.0% from April 2010 levels. Six of the 20 MSAs showed new index lows in April – Charlotte, Chicago, Detroit, Las Vegas, Miami and Tampa. Thirteen of the cities and both composites posted positive monthly changes. With index levels of 152.51 and 138.84, respectively, both the 10- and 20-City Composites are above their March 2011 levels, which had been a new crisis low for the 20-City Composite.”

Source: S&P

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.