Sorry for the lack of updates this week. I don’t know if you’ve heard, but there has been some stuff going on in the stock market and that makes for busy times. Anyhow, let’s cut to the chase.

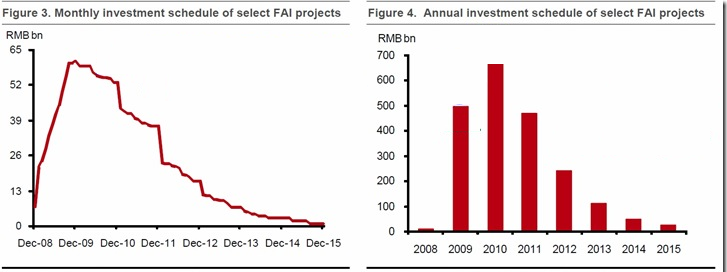

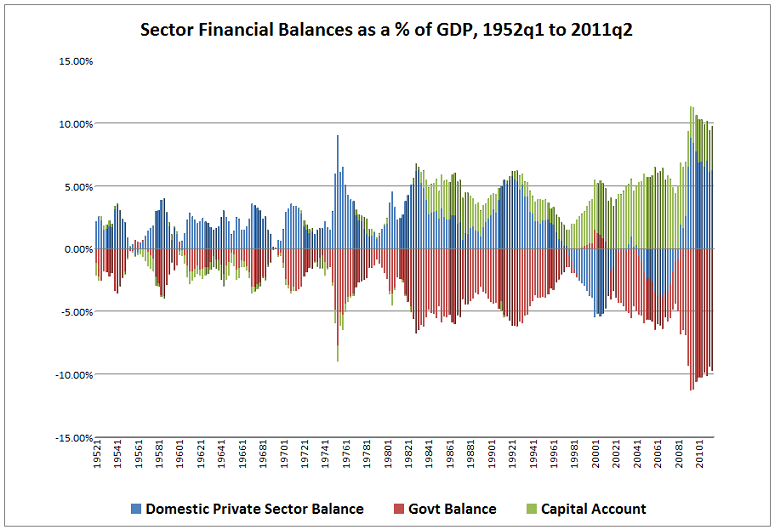

We are, in my opinion, in a balance sheet recession that is likely to persist for several more years. This means we can expect the private sector in the USA to remain very weak. Parts of Europe are also suffering from a balance sheet recession that is largely the result of an incomplete and flawed currency union. Asia has boomed in recent years. They remain the one strong leg of the global recovery. I have maintained that the Chinese economy experienced booming growth in recent years in large part due to their stimulus. It is my opinion that the stimulus was excessively large given their lack of real economic problems and is resulting in high and unstable inflation. Historically, these bouts of inflation have tended to result in a recessionary correction. As the stimulus winds down we should see downside risk in China. Whether this is the beginning of a new economic downturn is in question still.

The riskiest region of the world remains Europe by a wide margin. Austerity is now biting hard on the periphery and appears to be spreading. Italy’s balanced budget amendment is likely to impose further pressure on their economy which will exacerbate their debt woes. France’s recently announced austerity measures should also put downside pressure on their economy. This all creates a highly combustible environment in the coming year. As we know from this week’s market action, investors are very jittery about the potential for a banking crisis in Europe. Europe’s leaders are clearly behind the curve here and implementing more can kicking strategies that are unlikely to work. This means that there are extraordinary risks as the European economy weakens and the risk of a potential banking crisis increases. If the Germans are serious about not bailing out Italy we could experience a very serious calamity in the coming year. I would say that the risks in Europe are skewed heavily to the downside.

The U.S. economy is not nearly as bad as the media might have you believe (or even as bad as some of my recent commentary might make you think). The budget debates did not result in massive austerity and the USA is still running sizable budget deficits that should be large enough to offset much of the effects of the balance sheet recession as the consumer continues to de-leverage. Unfortunately, the stimulus from 2009 is winding down so there is downside risk as this works as a pseudo austerity. Fortunately, the sizable budget deficit should continue to bolster the US economy and provide for a muddle through environment. The major risks are exogenous although increased austerity would certainly hurt (we’ll see how this develops). The double dip debate is missing the boat in my opinion. We never left the last recession. It’s just that most people don’t understand that this isn’t your average recession – its a balance sheet recession.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.