If you tell a hyperinflationist that their thesis has been entirely wrong over the last few years (which it has) they inevitably respond in one way: “look at a chart of gold”. This is a reasonable response. The only problem is, it hasn’t been entirely true over the course of the last 10 years.

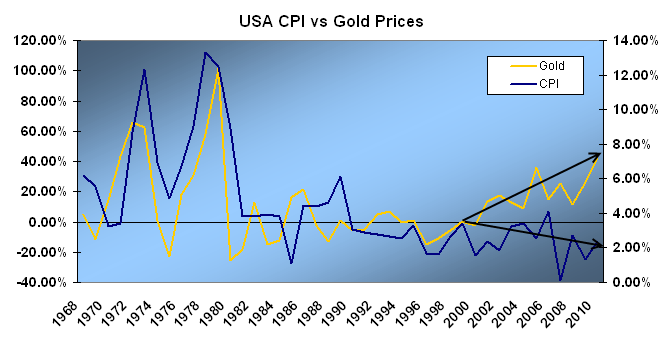

Since the early 70’s US inflation and gold prices have actually maintained a fairly high correlation. Figure 1, which shows the year over year rates of change, shows that gold prices have tended to track the CPI:

(Figure 1)

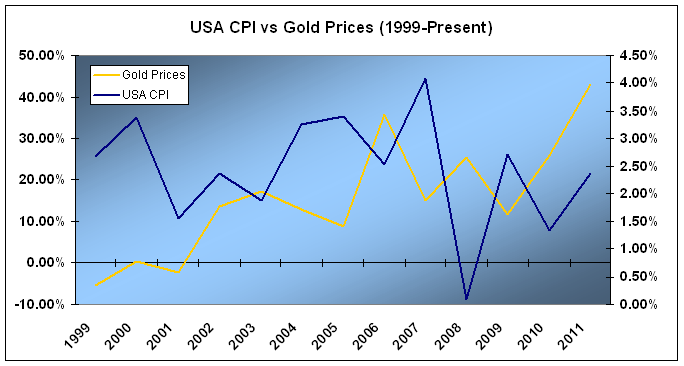

There has been a notable divergence over the last 10 years though. This is seen more clearly in figure 2 where we clearly see that gold prices have soared nearly every year during a period of stagnant economic growth in the USA that has generally been characterized by low inflation (the low inflation is easily confirmed by dozens of other independent variables including wages, bond yields, ISM price index data, ECRI Future Inflation Gauge, etc).

(Figure 2)

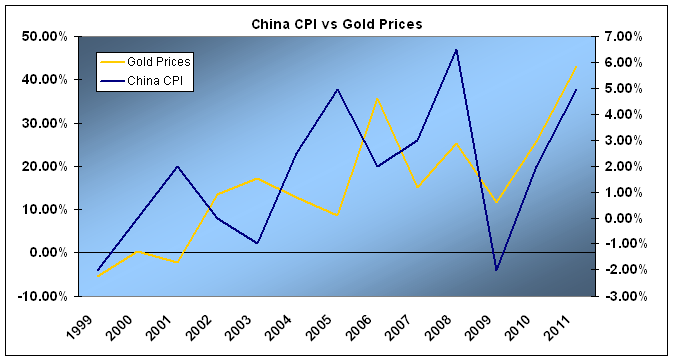

So what gives? Why do gold prices continue to soar as the USA continues to suffer through a period of low inflation and general economic malaise? The answer lies not in the “central planning” of the US government, but everyone else’s favorite “central planners” – China.

As we all know, China’s economy has roared to life over the last 10 years. Their government has increased the money supply at a 17% annualized rate as they try to sustain growth. Their inflation concerns are well documented.

Figure 3 shows the correlation between China’s CPI and gold prices over this period. As you can see, it tells a dramatically different story than the US CPI data does:

(Figure 3)

About a year ago I described three bullish trends in gold prices. The third trend was explained by UniCredit:

CR: I think the previous two trends are largely unfounded (though that doesn’t mean they won’t persist), however, the third trend is very real. UniCredit cites China’s surging demand for gold:

Unicredit: “The Chinese government has encouraged consumers to invest in gold, and with great success. In the last 12 months, demand for gold totaled 532 tons. While jewelry demand is merely stagnating, investors are increasingly discovering the gold market. While as recently as 2008 only 17 tons of gold were purchased, in 2009 the figure was already 73 tons. In the last 12 months, demand was even 143 tons! Although China has evolved into the world’s largest gold producer in recent years, the annual production of most recently 330 tons is by no means sufficient to satisfy this demand.

China announced important gold market reforms at the beginning of August. Foreign companies are now permitted to offer their gold coins at the Shanghai Exchange, more banks are permitted to import gold from abroad, and more domestic, gold-based investment products are to be developed. As a result, demand of Chinese investors will increasingly be felt on the global market. But the Chinese government also has an ever greater interest in gold imports. In April 2009, China had reported an increase in its gold reserves from 19.29mn to 33.89mn troy ounces. Nevertheless, they are still at a very low 1.7% of the entire foreign exchange reserves. If China is targeting a gold reserve of, for example, 10%, it would have to purchase 6,130 tons of gold or 2.4 times global annual production. If China were to meet the demand only from domestic producers, it would take 19 years to achieve this objective. Since the gold market is per se only a very small market, further increases in the price of gold are pre-programmed.”

This powerful trend can also be seen in the correlation between Chinese wages and gold prices:

(Figure 4)

I’ve built all of this into my reasoning for thinking that gold is entering an irrational bubble. And I believe one of the primary drivers of this inevitable bubble is this misconception that the USA and the Federal Reserve are the primary causes of inflation and gold prices. The reason the hyperinflation theory in the USA has been so wrong (aside from misunderstanding how the modern monetary system works) is because the hyperinflationists have misunderstood the actual cause of their inflation worries. They’ve no doubt been right (in terms of gold), but they’ve been right for the wrong reasons. In my opinion, it is not the “central planning” of the USA that is causing this fear trade. Rather, the true fundamental driver is the Central Bank of China.

The key for investors will be understanding the point where the gold market reaches disequilibrium based on these misconceptions (the Euro crisis and the Fed contribute significantly to this misconception) and undergoes the inevitable collapse that always follows a bubble. I personally don’t think we’re there yet. In the meantime, when someone points to the Fed, the US government and their “central planning” or “money printing” as the primary cause of the surge in the price of gold and justification of their USA hyperinflation theory, you might do them a favor and let them know that they’re right about the flaws of “central planning” and excessive “money printing”. You just might want to also let them know that they’re focusing on the wrong central bank.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.