We’re starting to see a lot of chatter about “value” in European equities. And not just from the usual talking heads. In the last few days a number of high profile investors have come out with bullish comments on European stocks after their 30%+ decline. Yesterday in a MarketWatch piece, London based value investor Crispin Odey said European equities were “mouth-wateringly attractive” (Via MarketWatch):

“It may be confusing to find someone who believes that a crisis is on its way but is also happy to buy equities ahead of the crisis,” he writes in his latest bulletin to investors. “My reason is that the worries have been there for so long, the causes are so obvious and the valuations are so cheap that this is a case of buying early. For me the crisis will bring resolution and with it higher prices…Equities yield 5-6% and many are on earnings yields of 20-33%. They are mouth-wateringly attractive.”

In yesterday’s note David Rosenberg added some perspective:

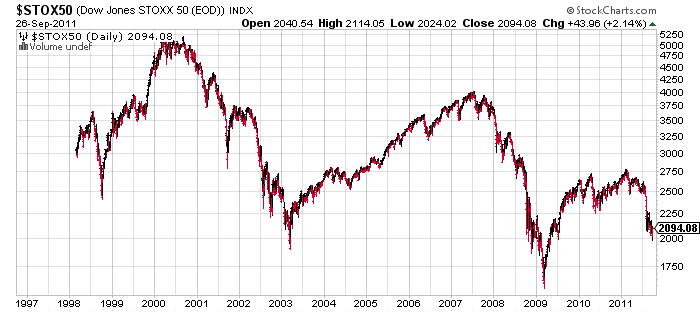

“If you are looking for value, the radically beaten up European stock market now trades at 26-month lows and at a mere 8X P/E multiple (close to where the S&P 500 was during the summer of 1982).”

Another high profile European hedge fund manager who I talk to on occasion mentioned that he was adding exposure to European equities in the last week based primarily on a value basis (I will never disclose the contents of emails sent to me so don’t bother asking who it is). I should also note that this investor says the same does NOT apply to U.S. equities which are still relatively expensive.

Over the last 15 years the Euro Stoxx 50 has been a substantial underperformer. While European stocks face enormous hurdles in the near-term I think, for the buy and hold or value investor, that European equities have to be a consideration given their current levels, relative value and potential for a near-term bullish catalyst in a Euro zone resolution. Mind you, this idea is not for the faint of heart or the impatient investor as near-term volatility and risks are likely to remain extremely elevated….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.