Markets have been reassured in the last few weeks by big changes in Europe (mostly in leadership) that will do absolutely nothing to help fix the root cause of the Eurozone crisis. The truth is, the sovereign debt issue is here to stay. As I showed last week, the math just doesn’t work in Italy. The likelihood of growing out of this mess is virtually zero.

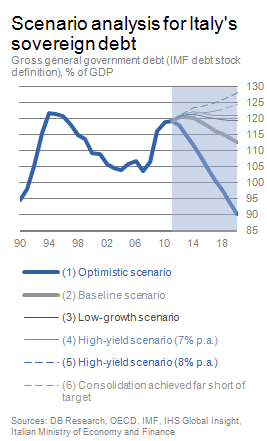

Over the weekend, Deutsche Bank published a brief note showing the potential paths of Italy’s debt. As you can see in the following analysis this is a problem that is not going away any time soon. In fact, in their baseline scenario the debt levels don’t improve from current levels for over 3 years! Via DB:

“But just how realistic are the chances of Italy’s being able to substantially and sustainably lower its chronically high debt level over the coming years? In the following we shall use a scenario approach to briefly analyse the sustainability of Italy’s sovereign debt. In doing so we shall project the potential curve of Italy’s gross general government debt in relation to GDP (according to the IMF definition of debt*) up to the year 2020 in six scenarios.

(1) In our optimistic scenario we build on the latest forecasts of the Italian finance minister up to 2014**, assuming that real GDP grows at an average of 1.1% p.a. over the next ten years. Furthermore, Italy succeeds in permanently raising its primary surplus (i.e. the budget balance before net interest payments) from -0.3% of GDP in 2010 to as much as +5.7% of GDP from 2014. Market interest rates, approximated in the following by the yield of 10Y Italian government bonds, come to hover at around 6% p.a. in the medium term. As a result of this, the nominal effective interest rate is assumed to rise gradually to roughly 5.6% by 2020 from around 3.5% in 2010.*** (2) In our more conservative baseline scenario, by contrast, the Italian economy only expands at an average of 0.9% p.a. over the next ten years. Similarly, we assume that the primary surplus inches up to merely 3.75% of GDP by 2016. Here, too, a market yield of 6% p.a. is assumed. In the next four scenarios we fundamentally adopt the same assumptions as in our baseline scenario; however, we vary the assumptions by altering individual variables, i.e. we perform a sensitivity analysis. (3) In our low-growth scenario we calculate the curve of government debt in the case when GDP growth falls appreciably short of expectations over the next ten years, averaging 0.4% per year. (4-5) In our two high-yield scenarios we analyse how a further increase in market rates to 7% and 8% p.a., respectively, would impact the sovereign debt. (6) Finally, we show the debt curve when the savings achieved fall far short of the target, i.e. the primary balance only increases to slightly over 2% of GDP by 2012 and remains at that level.****

Chart 1 shows the findings of our scenario analysis. While the debt ratio in the optimistic scenario noticeably declines to about 90% of GDP by 2020, it falls only slightly in our baseline scenario to just over 110% of GDP. In our low-growth scenario it would in fact remain unchanged at a high level. Whether Italy succeeds in substantially reducing its debt load (or whether this debt load perhaps even continues to increase) hinges largely on the assumptions made – this holds particularly for the future development of market interest rates. For example, on our assumption of an increase in the primary balance to +3.75% of GDP a medium-term reduction of debt falls out of reach from a market interest rate of around 7% per year. Given an even more significant increase in market rates, to say 8% p.a., the debt burden would climb to nearly 130% of GDP no less by 2020. In both cases there would cease to be any further grounds for long-term debt sustainability without additional measures (such as large-scale privatisations) and even more swingeing austerity programmes and/or the implementation of more decisive structural reforms that bolster potential growth.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.