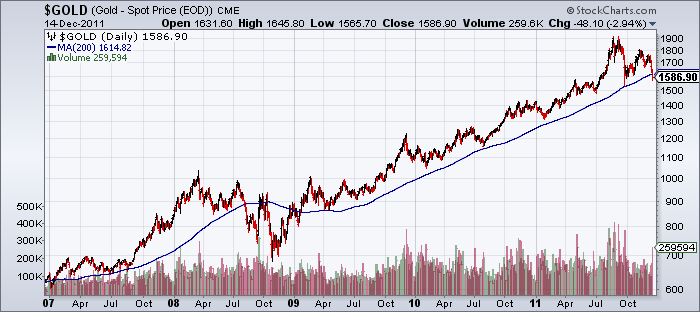

Here’s an amazing stat on the gold bull market from Bespoke:

“As the dollar has been breaking out, the price of gold has been breaking down. Today, gold dipped below its 200-day moving average (DMA) today for the first time since January 2009. If gold closes below its 200-DMA it will mark the end of the longest ever streak (732 trading days) of consecutive closes above its 200-DMA. Over the course of that streak, gold rallied nearly 125% to its highs earlier this year, and has since declined 16%. Even after the recent decline, though, gold is still up 88% since the last time it closed below its 200-DMA.”

You can see this in the chart below:

Charts are great for offering perspective into markets, but they’re only part of the story. The real question is whether the fundamental picture has changed with regards to gold. I think we’re seeing several macro causes for this break-down in gold prices. 1. China’s economic weakness suggests weakening demand from the gold market’s biggest bull. 2. The theory of hyperinflation and general fear of high inflation due to the world’s “money printing” measures has clearly fallen flat on its face.

The Chinese slow-down is a threat I’ve been discussing for a long time now and it remains one of the most worrisome trends in my macro outlook. Back in April, with the Shanghai 30% higher, European stocks 30% higher and silver almost 50% higher, I cited all three as “excessive risks”. Clearly, the macro outlook in Europe hasn’t changed much from then and I still maintain that China is a black box that could boom or bust. No one really knows outside of the central planners running the ship over there. But the risks are clearly abundant in any such environment with so little transparency.

The other concern (that deflation is on the horizon or that governments are becoming less interventionist and will fail to generate inflation) is likely blown out of proportion (as much as the hyperinflation story is blown out of proportion). As we push into 2012 we’re likely to see a real Euro solution as Italy’s debt problems resurface in Q1 and QE3 comes to the forefront. All of this “money printing” talk (however misguided it is) will bolster gold prices.

But let’s be clear on a few things. Gold serves like an insurance policy in a portfolio and should never be THE portfolio (I currently hold roughly 5% of my entire holdings in gold). If you’re excessively overweight precious metals in your portfolio you’re making a directional bet on a narrow macro thesis. That’s poor risk management at the very least. Right now gold continues to serve as a fine hedge against uncertainty and a world in which governments are viewed as the cause of the problem and not the solution. I don’t think that story has changed in the last few weeks and if there’s a government that’s willing to throw more money at a problem I think we can all count on China for that. So clearly, the China risks, while enormously bearish for all industrial metals, have the potential to feed right into the gold bull thesis if they respond with their usual “build something in the desert” economic growth plan. In short, I don’t think the fundamental picture has changed all that much.

Don’t worry gold bugs. Your bull market isn’t over….yet. Silver, on the other hand….well, we put at fork in that one a long time ago….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.