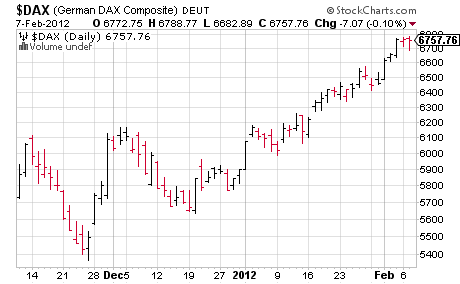

Europe’s LTRO has far surpassed most investor’s expectations and my brief rental of German equities in September is now looking like a mistake. The LTRO program has proven far more beneficial than I expected it to be and European stocks have boomed since Q3 last year with German equities surging almost 40% from their lows.

But the real story for equities has been in 2012. So far this year the S&P 500 has yet to experience a single -1% down day. And while the S&P 500 is up almost 6% YTD, its performance is nothing compared to German equities which have been the primary beneficiary of healing in Europe. The Xetra DAX is up 14.5% year to date! For those playing the trend following game, that’s a 143% annualized return….My guess is some German equity traders are packing it in the for year after a very healthy gain….After all, 145% annualized isn’t exactly sustainable and 14.5% is a pretty good year given the way this market has yo-yo’d these last few years….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.