It’s not unusual to see the 1987 market crash bandied about supporting extreme claims. This outlier event is often misrepresented by bears who are trying to prove why a certain market environment is at risk of a crash or a serious market decline. In this morning’s Hussman letter, John Hussman mentions the 87 crash in response to the thinking that falling jobless claims are at odds with the potential of a market decline. He says:

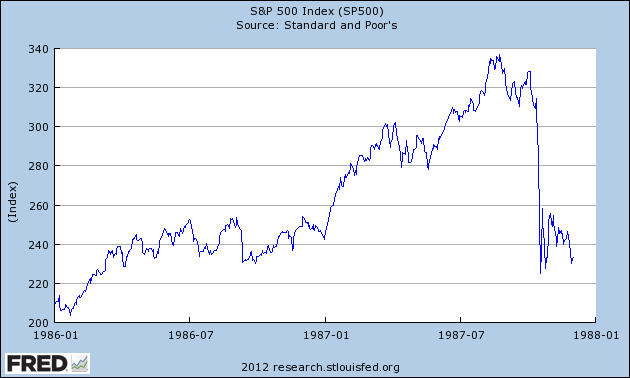

“A particularly instructive instance is 1987. The chart below shows the 4-week average of new claims for unemployment that year. Notably, the persistent downtrend in new unemployment claims provided no barrier at all to the October 1987 crash. I’ve chosen this particular counterexample because we presently observe the same unusually overextended market conditions that characterized the 1987 peak. These include an overvalued, overbought, overbullish syndrome, which has become increasingly familiar near both major and intermediate market highs in recent years, including the peaks we saw in 2007, 2010 and 2011. The 1987 peak also featured the same “exhaustion syndrome” I discussed a few weeks ago in Goat Rodeo (basically a recent “whipsaw trap” syndrome coupled with falling earnings yields).”

I don’t mean to target Dr. Hussman here (in fact I agree with his thinking that we’re overbought and overbullish currently), but reading this reminded me of this myth that we so often see – the myth that today somehow can be compared with the market crash of 1987.

Last year, just prior to silver’s big collapse, I discussed the elements of a bubble and how market disequilibrium forms. I wrote:

Characteristics of bubbles:

- Strong fundamental underpinnings. Bubbles do not merely appear out of nowhere. Bubbles grow over a period of time based on strong fundamental underpinnings. There is always a very good economic reasoning behind bubbles. This feeds into the rationalization of its existence and justifies a “it’s different this time” mentality that later occurs.

- Ponzi builds. A naturally occurring ponzi process begins. As a recency bias builds (the tendency to overweight recent events and ignore historical facts) the system begins to exhibit herding behavior as more and more investors get in on “the only game in town”. This becomes amplified by the media, those with a vested interest in this particular market, those who “throw in the towel” after wrongly betting against the trend, etc.

- Illusion of stability within disequilibrium. The illusion of control increases as investors become increasingly confident in the market. They increase their bets, increase price targets, etc. Investors begin to convince themselves that it is “different this time”. All of this is occurring as the system grows increasingly unstable. I like to think of it like a spinning top. When you initially throw a top into a tight spin there is a distinct order in its movements. They are predictable and stable. But as the top loses momentum it begins to spin uncontrollably. The system becomes unstable, unpredictable and ultimately breaks down. Bubbles work within the same sort of illusion. What appears like a stable and self sustaining system is in fact increasingly unstable and entering an inevitable disequilibrium that breaks down.

- Systemic collapse. All bubbles collapse. It is never “different this time”. As this prior herding effect begins to break down there is a flood for the exits as the herd reverses its controlled march into a panicked stampede. The gig is up. Collapse ensues.

The key element of any unstable market environment is the illusion of stability within disequilibrium. What most investors fail to note leading up to 1987 was that the market had been on an incredible tear. In the 22 months leading up to the crash the S&P 500 had rallied 60%. In the 10 months leading up to the crash the S&p 500 had rallied almost 40%. All the crash did was take us back to break-even. The more important part is that this sort of upside move is an outlier event. And while these kinds of moves might have been supported by improving economic data and earnings, they’re rarely justified by the extent of the ponzi effect and its ensuing disequilibrium.

Investors will often look at these events for a catalyst and a cause without realizing that the cause was right in front of them. All you need is a good rear view mirror. When a market enters this sort of a disequilibrium based on herding it always breaks. And like the 2010 flash crash, the cause can be just as simple as “investor psychology changed”.

A simple (and stupid) analogy is Monday mornings. Odds are that you spent your weekend doing something you enjoyed. Maybe you watched a sporting event, attended church, watched the Grammys. Who knows. But then you woke up Monday morning and realized you were going to go to work and spend part of your day reading my boring thoughts on markets. It’s the rollercoaster of emotion that is part of human life. Stability creates instability. It’s just part of life. We don’t need some fancy explanation to know why Monday morning is no fun. It just isn’t as great as the weekend, when you do whatever you want. It’s the low in our rollercoaster. The same rollercoaster occurs in the markets in a much broader sense with the herd driving the collective emotions.

I don’t know what’s going to happen next in the markets. I would describe today’s market as one in which we’re all enjoying our weekend. And Monday always comes. But the point of this story is to show that some weekend’s are better than others. They breed greater instability which gives the appearance of an even worse Monday when it comes. Too often, we see people make comparisons to 1987 without realizing that that particular weekend was one heck of a good party. The Monday (and Tuesday) hangover just so happened to wipe out the fun. But be careful about listening to people who compare today’s environment or many others to 1987 (not that Dr. Hussman is calling for a crash). Market bubbles will continue as long as humans exist, but these unstable environments are preceded by very specific events.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.