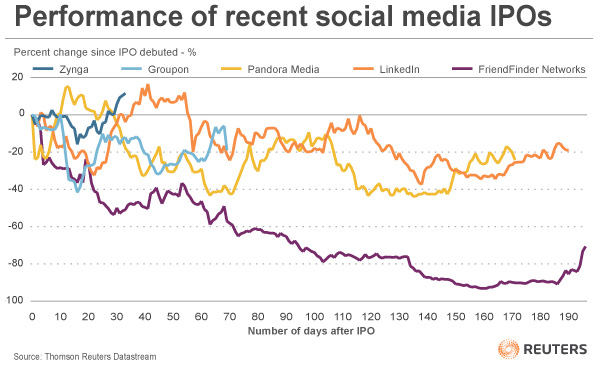

Will Facebook prove different than many of the other recent social media IPO’s? Via Reuters:

“The chart below shows the extent to which companies like LinkedIn, Groupon and Pandora have struggled in the wake of their IPOs. Investors who wanted a piece of the social networking action and who bought at the IPO price have been sorely disappointed and some have begun to wonder whether the social networking phenomenon will end up generating as few successful and long-lived public businesses as the first wave of Internet IPOs back in the late 1990s. That dot.com boom ended in a dot.com bust, with a handful of survivors such as eBay and Amazon generating – over time – significant profits for a handful of investors but resulting in large losses for many more speculators betting on the trend rather than the company.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.