According to this morning’s productivity report unit labor costs jumped far more than expected at a 2.8% rate in the fourth quarter. This is likely to add to the recent evidence that the Fed won’t enact QE3 any time soon. With the core rate already at the high end of the their range and unit labor costs on the rise they’re likely to be in a wait and watch mode. Via the BLS:

“Unit labor costs in nonfarm businesses increased 2.8 percent in the fourth quarter of 2011, as productivity grew at a slower rate (+0.9 percent) than hourly compensation (+3.7 percent). Unit labor costs rose 3.1 percent over the last four quarters. Annual average unit labor costs increased 2.0 percent from 2010 to 2011.”

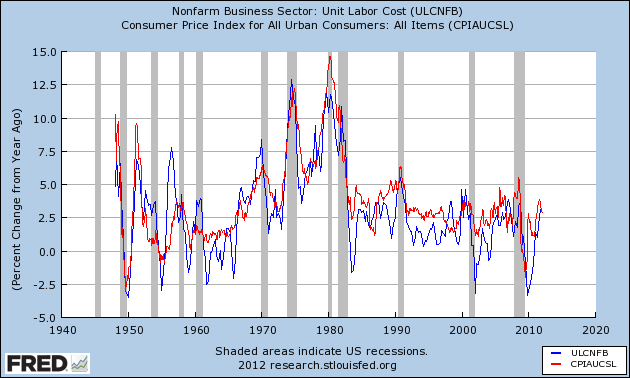

And as you can see below, unit labor costs are very highly correlated to inflation. This 2.8% rate is nothing to panic about, but it’s certainly enough to put the Fed on wait and see mode:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.