By Charles Rotblut, CFA, AAII

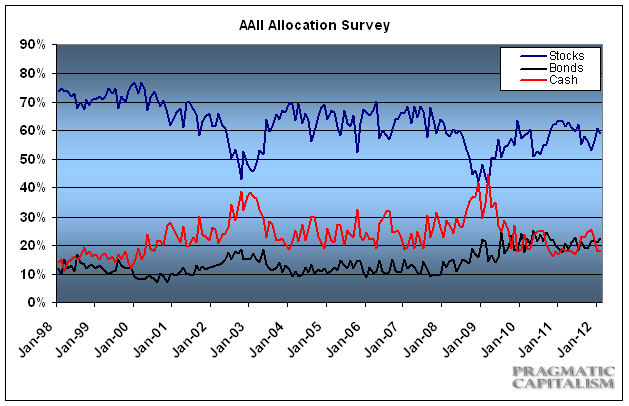

Though individual investors made only minor revisions to their portfolios, cash allocations rose to a four-month high according to the April AAII Asset Allocation Survey.

Stock and stock fund allocations were 60.6%, a decline of 0.1 percentage points from March. This was the third consecutive month in the last four that equity allocations were above their historical average of 60%.

Bond and bond fund allocations were 18.8%, a decline of 0.2 percentage points from March. This was the first time since October 2011 that fixed-income allocations were below 20% for two consecutive months. Nonetheless, bond and bond fund allocations were above their historical average of 16% for the 34th consecutive month.

Cash allocations rose 0.3 percentage points to 20.7%. This is the highest allocation to cash since December 2011. It is also, however, the fifth consecutive month that cash allocations have been below their historical average of 24%.

Though AAII members became more pessimistic about the short-term outlook for stock prices in April, they largely left their portfolio allocations unchanged. Stocks have had a strong start this year, though worries about the pace of U.S. economic growth and global sovereign debt are keeping equity allocations close to their historical average. At the same time, many individual investors are using capital preservation strategies for a portion of their portfolios even as they remain frustrated with the low yields offered by bonds and money market accounts.

This week’s special question asked AAII members what changes they have made to their portfolios in response to the first-quarter’s rally in stocks. The largest number of respondents said they have not made any changes or they thay have only made what they described as minor changes. Onesmaller group of respondents said they sold stocks and raised their cash allocation, while another small group said they bought stocks. (Slightly more said they sold stocks than said they bought stocks.) Several respondents said they rebalanced, bought high-quality dividend-paying stocks or were monitoring their portfolio more closely.

Here is a sampling of the responses:

- “I do not make changes based on short-term rallies.”

- “I rebalanced back to my target percentages, selling some stocks and buying intermediate-term bond funds.”

- “No changes. I am well diversified and rebalance any time I am more than 5% off my allocation. I am not a ‘market timer.”

- “I’ve only made small transactions. Overall, the portfolio is about the same.”

- “I added several blue-chip, dividend-paying stocks.”

- “I have begun to take profits and adjust my stop limits upward since I’m expecting a correction between now and June.”

April Asset Allocation Survey Results:

- · Stocks/Stock Funds: 60.6%, down 0.1 percentage points

- · Bonds/Bond Funds: 18.8%, down 0.2 percentage points

- · Cash: 20.7%, up 0.3 percentage points

March Asset Allocation Survey Details:

- · Stocks: 28.8%, down 2.8 percentage points

- · Stock Funds: 31.8%, up 2.7 percentage points

- · Bonds: 3.8%, down 0.7 percentage points

- · Bond Funds: 15.0%, up 0.5 percentage points

Historical Averages

- Stocks/Stock Funds: 60%

- Bonds/Bond Funds: 16%

- Cash: 24%

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.