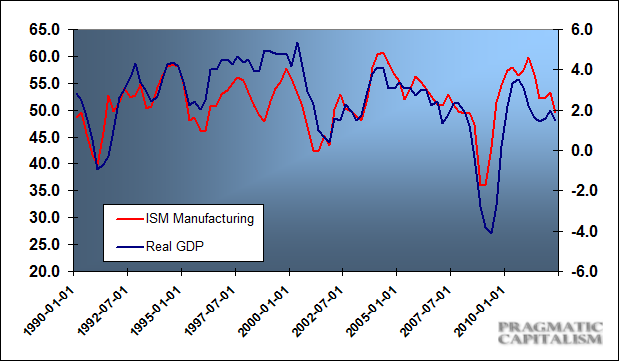

The “no recession” theory took a blow to the head today as the ISM Manufacturing index officially turned south into contraction range. The Institute’s Bradley Holcomb gives the brief break-down:

“The PMI registered 49.7 percent, a decrease of 3.8 percentage points from May’s reading of 53.5 percent, indicating contraction in the manufacturing sector for the first time since July 2009, when the PMI registered 49.2 percent. The New Orders Index dropped 12.3 percentage points in June, registering 47.8 percent and indicating contraction in new orders for the first time since April 2009, when the New Orders Index registered 46.8 percent. The Production Index registered 51 percent, and the Employment Index registered 56.6 percent. The Prices Index for raw materials decreased significantly for the second consecutive month, registering 37 percent, which is 10.5 percentage points lower than the 47.5 percent reported in May. Comments from the panel range from continued optimism to concern that demand may be softening due to uncertainties in the economies in Europe and China.”

This is an increasingly curious data point as new orders collapsed to 47.8, prices crater (to 37), export orders are dragged down by global weakness, but employment remains firm at 56.6. But even at 49.7 it’s too early for recession calls. The meager contraction is still consistent with GDP in the mid 1% range so if we’re truly headed into a “recession” then this is the equivalent of a boxer on one knee who falls back to the mat. Still, the recession calls look increasingly credible as the year goes on.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.