I am beginning to see the term “housing recovery” all over the place these days. I googled “housing recovery” and narrowed the results down to the last 30 days and 3,900 results show up. It sure seems like the “housing recovery” has become a widely accepted fact. Now, I’m no longer some big housing bear like I was for so many years. I actually don’t think there’s much downside in US residential real estate, but I also think we’re getting a bit ahead of ourselves here. Let’s take a look at the data just for some broader perspective.

The most damning chart for the “housing recovery” is house prices themselves. What’s sparked all the recovery chatter? Strangely, it’s been that 2.5% spike off the bottom. The current bounce is actually much weaker than the 6%+ spike we saw in late 2009:

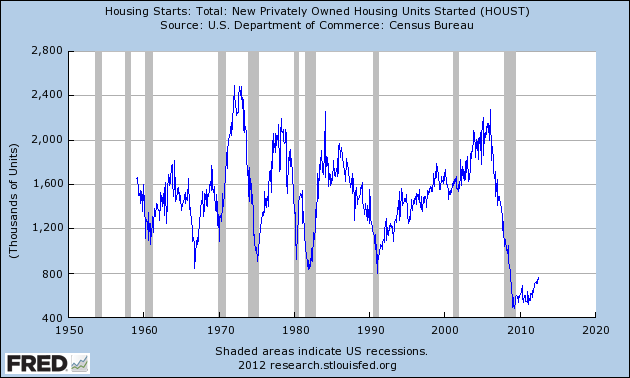

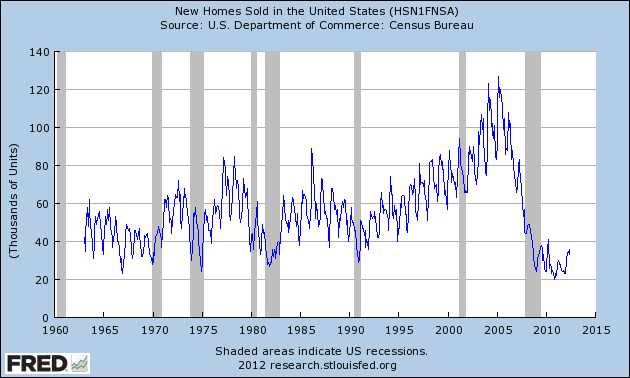

Okay, but prices aren’t everything. Surely, the underlying data is starting to look better also, right? I guess it’s all relative and in this bizarro Great Recession world where “good” would have once been considered “bad”. The next few charts are just big broad housing indicators. As you can see, they’ve certainly “recovered”. Recovered right back to some of the worst levels in US history:

Housing Starts

Building Permits

New Home Sales

I hate to rain on the parade here because housing stability has been a huge factor in my “no recession” call over the last year +, but I think we have to keep some perspective here as well. I don’t know what the technical definition of a “recovery” is in economics, but this is not a “recovery”. It might be a “stabilization”, but let’s not go all crazy abusing the english language here. I was a housing bear for years and years and I am infinitely more optimistic about the state of US housing here. But let’s be honest here. This is no “housing recovery”.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.