Here’s an interesting fact sheet via Steve Hanke, professor of economics at John Hopkins:

1. Iran is experiencing an implied monthly inflation rate of 69.6%.

- For comparison, in the month before the sanctions took effect (June 2010), the monthly inflation rate was 0.698%.

2. Iran is experiencing an implied annual inflation rate of 196%.

- For comparison, in June 2010, the annual (year-over-year) inflation rate was 8.25%.

3. The current monthly inflation rate implies a price-doubling time of 39.8 days.

- For certain goods, such as chicken, prices may be doubling at an even faster rate.

4. The current inflation rate implies an equivalent daily inflation rate of 1.78%.

- Compare that to the United States, whose annual inflation rate is 1.69%.

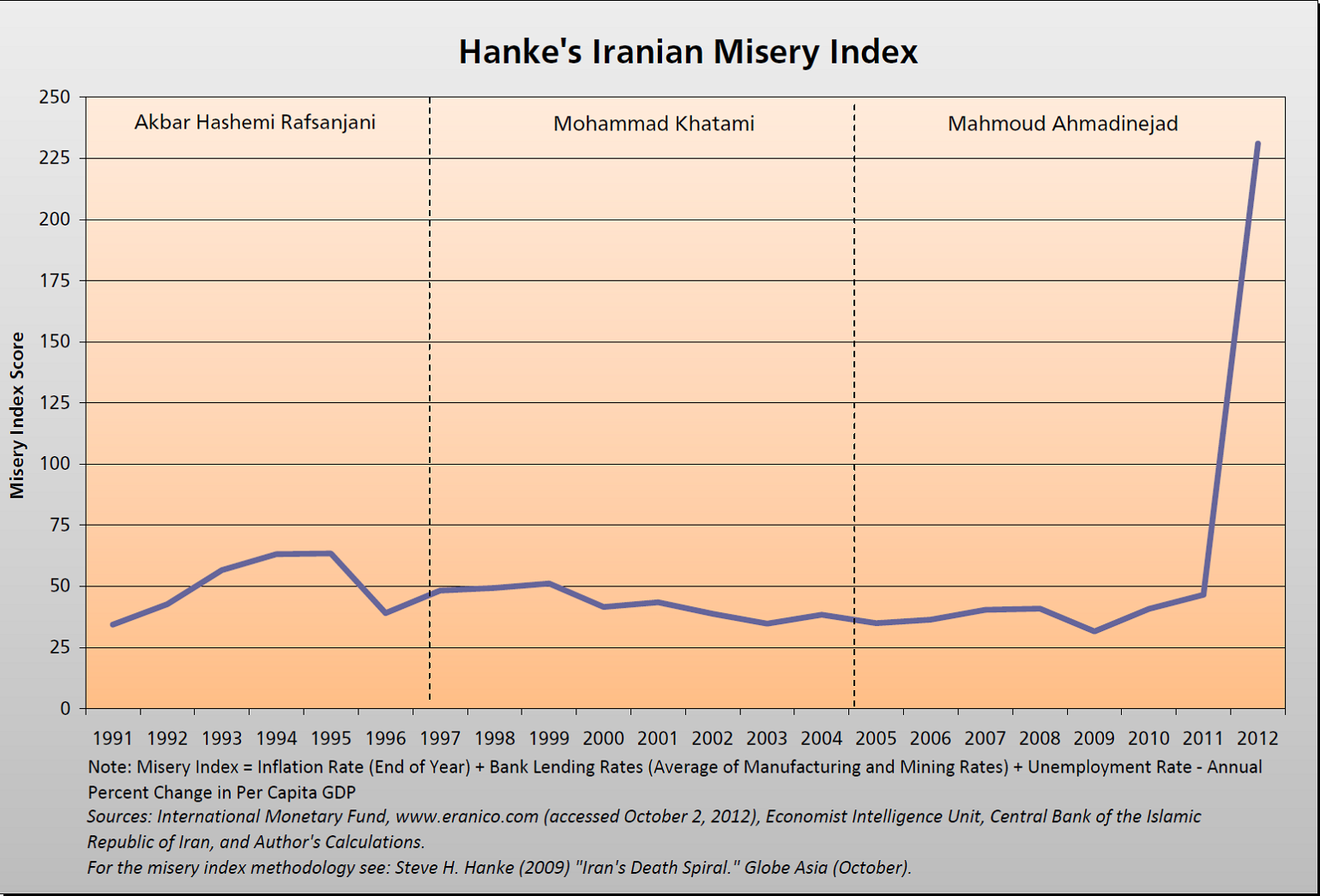

5. Since hyperinflation broke out, Iran’s estimated Hanke Misery Index score has skyrocketed from 106 (September 10th) to 231 (October 2nd).

- See the accompanying chart.

6. Iran is the first country in the Middle East to experience hyperinflation.

- It is the seventh Muslim country to experience hyperinflation.

7. Iran’s Hyperinflation is the third hyperinflation episode of the 21st century.

- The first was Zimbabwe, in 2008. The second was North Korea, whose episode lasted from 2009-11.

8. Since the sanctions first took effect, in July 2010, the rial has depreciated by 71.4%.

- In July 2010, the black-market IRR/USD rate was very close to the official rate of 10,000 IRR/USD. The last reported black-market exchange rate was 35,000 IRR/USD (October 2nd).

9. At the current monthly inflation rate, Iran’s hyperinflation ranks as the 48th worst case of hyperinflation in history.

- Iran currently comes in just behind Armenia, which experienced a peak monthly inflation rate of 73.1%, in January 1992.

10. The Iranian Rial is now the least-valued currency in the world (in nominal terms).

- In September 2012, the rial passed the Vietnamese dong, which currently has an exchange rate of 20,845 VND/USD.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.